Not a Penny More:

This was a very interesting question I got asked recently and it really got me thinking. So much so, that I decided it warranted an entire article to address it. The question is: when can you stop saving money and be confident that you’ll retire securely? In other words, when is the nest egg that you’ve squirreled away big enough that you’ll be able to loosen your wallet and start spending all of your income. This sentence probably made prudent frugal savers panic a little, trust me I know, I’m one of them. For the sake of argument, let’s do the thought experiment. When will the amount of money you saved be able to grow enough to allow you to retire by your planned retirement date, without saving a penny more. When will this small nest egg of money compensate for a lack of savings? Lets find out.

Psychology of Money

This question fascinated me because it also bridges into another domain related to the psychology of money. I think there’s almost a secondary underlying question here, when is enough, enough? When can you relax a little and spend a bit more on life, knowing that one day you won’t be here, or that one day you won’t be able to work the same way you can today? Well, let’s do some math, make some assumptions (which are always wrong if your time horizon is large enough), and see what we can magic our way into existence.

Step 1: Understanding Your Annual Expenses in Retirement:

There are a few ways to approach this problem. But they all require understanding what your monthly expenses are, and what you plan for them to be when you retire; plus a little safety cushion since inflation can be somewhat unpredictable. Lets take myself for example. I currently live in a 1 bedroom apartment in Toronto, I’m paying $1200 a month in rent, with all the other random bits a bobs of expenses, having a car, travelling between two cities for work, student loans, eating, gym membership, stupid financial mistakes. I’m burning around $3000 a month. I can see how it’s feasible that in the somewhat near term future, I move into a new house and my expenses jump again. Let’s say that 5 years from now I’ll have doubled my expenses due to a mortgage and lifestyle inflation etc. Let’s say another 5 years after that I’ll be spending close to $10,000 a month raising a child and all the expenses that come along with that. After which point let’s say that the expenses stay somewhat steady.

Now let’s think about retirement. In retirement, I’d probably want to travel a bit. At which point my mortgage should be paid off and I won’t be raising kids anymore (probably). So if I aim for around $12,000 a month in spending or $144,000 per year in expenses, that gives me a good goal to reach for. I will say, from the relatively moderate amount of money I’m making and spending now, it seems a bit crazy to me that I might some day be spending anywhere near $12,000 a month, but things do get more expensive with time, lifestyle inflation is a real thing, and just based on recent history I think taxes will be higher 40 years from now than they are today which will eat away a bit at the budget. Someone come back to this post in 40 years to fact check me on that.

Now that we have come up with these hypothetical numbers, and assume that we’ll be spending $144,000 a year in 2065, we can reverse engineer a bunch of ways to get our income up to that level. This is the point at which the potential pathways really start to branch off and the old saying “there’s a million ways to make a million bucks” starts to involve itself. But instead of a million methods, lets narrow it down to 3 or 4. Namely: Stocks and Dividends, Real Estate, & Business Income.

Method 1: Stocks and Dividends:

Bank Stocks:

One way to “retire” or “stop saving” is to have enough money saved and invested in dividend paying stocks that all of your annual expenses are covered. For example, a common method of doing this here in Canada is through the big 5 bank stocks and insurance companies. They pay out around 4-6%/year depending on the bank and the time at which you bought shares. Some of these businesses have over 100 years history of paying their dividend so you can rest pretty well assured that you have a decent shot of seeing that payment into old age. Canada also tends to have a better history than the US of regulating it’s banks for stability. But if you are worried about bank collapses and the like, it may still be prudent to diversify among banks and not put all your eggs in one basket or even one country. 2008 proved that you can in fact mess up being a bank, and it can happen in multiple countries.

Oil and Gas:

Oil and gas stocks also have a great history of paying very good dividends anywhere from 7-12% depending on the stock. Many oil and gas companies also have the claim to fame of being around for over 50 years some approaching 100 years. Nowadays, a lot of oil and gas companies are investing in green energy, but I think the lions share of their income continues to come from oil. I would consider oil a slightly higher risk investment than banks, but I also really don’t see these companies going anywhere anytime soon. You also have to invest in line with your morals and there are a lot of people who do not invest in oil and gas simply because it goes against their beliefs and that’s perfectly fine. You have to make a decision on what to invest in. However, to counter the green argument, you may need less money invested in oil and gas in order to “retire” and stop saving, so the trade off may be worth it to you.

Now that we have 2 industries, lets do some math. Assuming that we’re all in on one industry or the other. How much money you’d need saved up in order for dividends to fund your life in retirement? If we take a 5% dividend rate for banking, we can simply divide our annual expected expenditures of $144,000 by 5%. Which results in a portfolio value of $2,880,000. Just to be safe lets round up and call it $3 million. For oil and gas if we assume an 8% dividend, you’d need a portfolio of $1,800,000. I’m going to stick with banks simply because I think it’s a safer investment and the larger portfolio leaves more room for error. If you recall our original framing, we will need the $3 million portfolio when we plan to retire in 2065. That doesn’t mean we just save money every day a stick it into a savings account until we hit $3 million. Naturally, you’d want to invest the money along the way so that it’s working for you while you’re working to earn money.

The Power of Compounding:

This is where an important concept called compound interest comes into play. We have 40 years of investment to play with here. So lets play a fun game and determine what will happen if you have x dollars today, and you didn’t save a penny more, what that money would become in 40 years. (This will also be useful for future examples).

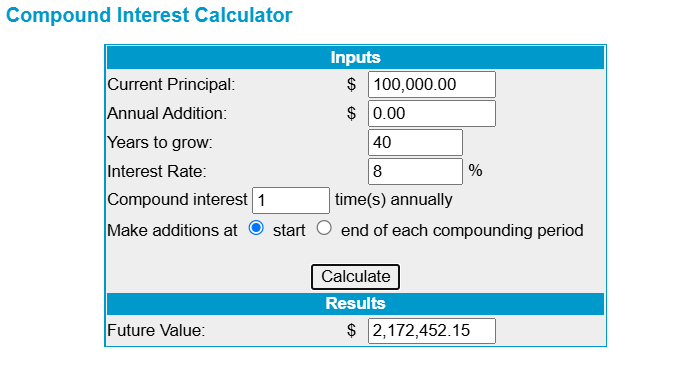

Compounding: $100,000 for 40 years @ 8%:

I pulled out the trusty old compound interest calculator for this example. Again, some assumptions have to be made. I’ve used a growth rate of 8% as that is what is commonly quoted as a sustainable long-term interest rate for your money invested in the US S&P 500. We have to use some assumptions, so this is what I’ll be using. If you want to be more conservative you can adjust the compounding rate lower to account for stupid mistakes or underperformance of stocks. For the sake of these examples I’ll stick with 8%. You can see that if we start with $100,000 at age 25, using our assumptions, we’ll be 65 with $2,172,000. Not too shabby.

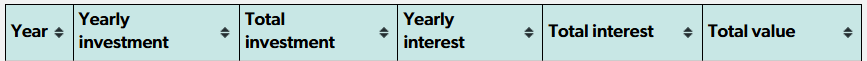

The truly crazy thing about compound interest is that the real explosive growth is at the end, it will take 30 years for the $100,000 to grow to $1,000,000 as seen in the last column of this chart.

However, the following 10 short years, the money grows MORE than $1,000,000 as seen below:

Our final number is $2,172,000. This is still about $800,000 short of our target of $3,000,000. But it’s pretty damn good for not saving a penny more for 40 years.

Something that makes this EVEN crazier is thinking about what might happen if you START with $1,000,000 and invest it this way. In 10 years, you’ll have made over $1,000,000. In 40 years, it gets truly INSANE, as you’ll see in the third example below. There is REALLY something to be said for saving and investing AS SOON AS POSSIBLE. Time and patience are the true money makers.

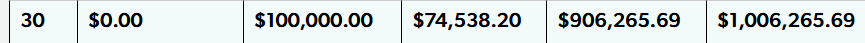

Compounding: $500,000 for 40 years @ 8%:

So let’s just jump into a whole other world, and say that we somehow accumulate $500,000 at age 25. Well, if we just invest it and do nothing more, it can become almost $11,000,000 in 40 years. For most people that’s a “holy s***” amount of money. Obviously, the reality of having worked and saved $500,000 by 25 years old is not likely to say the least. But, there are a handful of people out there who have secured their future well beyond what they’ll need at the ripe age of 25.

Compounding: $1,000,000 for 40 years @ 8%:

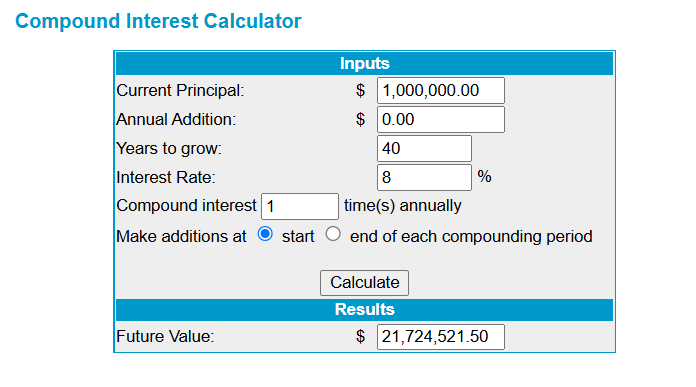

This is where the true insanity begins. At this point we’re pretty far diverged from the original question and from most people’s reality. But I find this stuff fascinating so bear with me. If you recall from above, $1 million dollars grows to about $2 million in 10 years using our assumptions. If you give it another 30 years. According to this VERY linear calculator (read: no likely). You could end up with over $21 million dollars by age 65. Crazy. Absolutely wild to most people. Ok enough daydreaming, lets get back to reality. How much money would I actually need to save to get my $2,880,000 portfolio number.

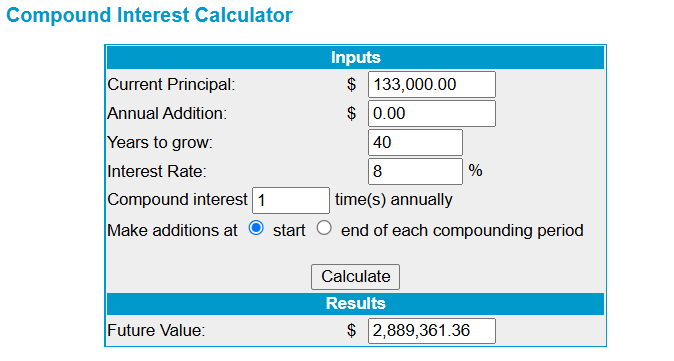

Compounding $133,000 for 40 years @ 8%:

I found that quite a close estimate to get to the retirement number is $133,000. This is still a lot of money for a 25 year old to have squirreled away, but not an entirely farfetched amount of money to have at that age. Do I know any 25 year old’s (soon to be part of the gang) with $133,000? I can’t say that I do, and even if I did I can’t say that they’d want me to know. But considering that it takes 4 years to get a university education and you could start earning a decent salary by 22 or 23, if you live at home for a couple of years and don’t spend a dime, yeah you could have over $100,000 saved within a few years. The name of the game is work your butt off, keep your expenses low, live at home as long as possible, and profit. The hard part will be not touching the money for the next 40 years.

Bringing this example to a conclusion. As seen above, if our dividend stocks are paying out 5% per year and our spending will be $144,000 a year, we’d need to have about $2,880,000 saved by 65. This can be achieved by starting with $133,000 at the age of 25 and investing it in the S&P 500 for 40 years, in theory. The gargantuan amount of assumptions here probably has statisticians rolling in their graves. But what can you do. If this example isn’t completely relevant to you then you can definitely do this yourself and adjust to your scenario start at a different age, change the dollar amounts etc. However, fair warning, the older you begin investing the larger the starting number has to be. I had a short story here about how investing young set me up for success, was a bit too much of a diversion, that’ll likely be my next post. For now onto method 2.

Method 2: Real Estate:

How Many Rentals?

Many people who have done well in life usually have some amount of involvement in real estate. So I’m going to approach this from the angle of the monthly rental income amount that you’d need in order to retire on rent payments. Naturally, to buy real estate you need some starting capital for the down payment, and a good income to qualify for the mortgage. So the hurdles are a bit higher. The nice thing with this example is that we can stretch the timeline. Most mortgages are 25 years in Canada.

Shorter Timeline

This means that even if we start investing at age 35-40, we can retire 25 years later with paid off homes that cash flow a good amount of money every month. You can also make the argument if you’re a younger person that, “hey, if you’re telling me there’s a way to hit my number in 25 years, why should I do the other method?” Good question, and good thinking. Depending on when/where you are looking for a house, you may find that even the $150,000 you have saved at 25 isn’t enough for a down payment on the house that you would like to invest in. You may also be in the strange position of not having a high enough income to qualify for the mortgage, but in theory having a large enough down payment. This might mean that you have to progress in your career a bit more before buying, or team up with someone else, to begin investing in real estate. I have written a couple blog posts about real estate investing so check those out too for more tips and tricks.

Historical Rents Growth

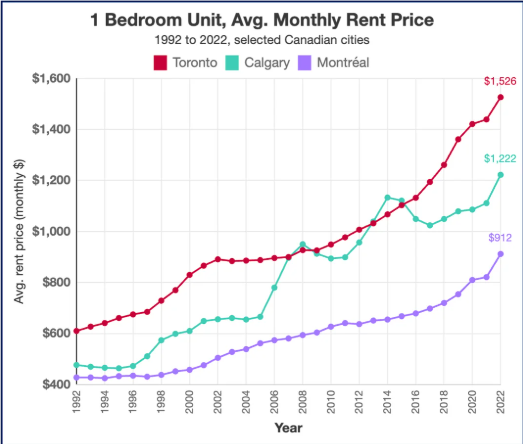

So let’s see what it would take to generate $12,000 a month in rental income (profit) from our rental properties. First thing that we should do is find out what the average rental growth rate has been historically in the city that we want to invest in. I’m going to take Toronto as my example. I found this handy chart:

Which shows the average monthly rental price of a 1 bedroom unit in Toronto. In 30 years it went from $600 to $1525. So if we divide the two 1525/600 = 2.5417, that’s about a 2.5x increase in rent prices in 30 years. I think this is a fair assumption to make and may even be on the more conservative side..

Target Rent Amount

So we can take our target number of 12000/2.5 = 4800. So we need a portfolio of properties that will be paying $4800 of rent today, in order to retire on $12,000 of rent in 30 years or so. I’m a bit worried about the state of rent growth in Toronto to be honest at the moment, so I’m going to target $6000 of rent today. It’s important to remember that we don’t really care if these houses are making a profit while we are paying down the mortgage, re-investment is fine. Once the mortgage is paid off, all of the money will go straight to you instead of the bank, which is the goal at the end of the day.

Example Property

Searching through recently sold listings on the MLS I was able to find a property that almost perfectly fits the bill. It’s a 2 unit property in the Annex neighborhood of Toronto (one of my favourites). Close to downtown, U of T, Yorkville, and hundreds of restaurants. It was sold in August of 2024 for $1,250,000. One unit was comprised of the 2nd and 3rd floors and this was listed for rent at 4800 after closing, and the main floor unit was listed for rent at 2400. Nowadays, rental discounts are quite common, but even if both units rented out for just under asking, they would have almost exactly $6000 in rental income, which hits our target.

Mortgage and Carrying Costs

The mortgage on the house would have been around $6200 based on a 5.5% fixed rate at the time of purchase assuming a 20% down payment, so it would likely cost around $1000 a month to carry the home factoring in all expenses and property taxes etc. or around $12,000 a year to carry. Believe it or not that’s not horrible for a big city. Especially considering that this type of housing has historically appreciated 6.7% over a long time horizon.

Closing Costs and Rates

You also have to factor in the fact that interest rates have come down since August 2024, so if you took a variable or open mortgage at the time you could wait until rates get a bit better and then lock in a fixed rate mortgage and get even closer to breakeven on your expenses. Let’s talk closing costs. The 20% down payment would be $250,000, land transfer tax in Toronto would be around $40,000 since you get hit with a double tax. Then misc closing fees probably add another $5000, then just throw in $5000 in repairs and unexpected costs and you need to come up with around $300,000 to close on this house.

100% of Zero

$300,000 at 25 as we’re assuming in this example, is not something that most 25 year old’s will have. However, if you potentially pool in with another person, whether that’s a spouse, a parent, or a business partner or two, you might be able to come up with the cash to do something like this. Yes you won’t get 100% of the benefit for yourself. But if you NEVER do something like this you’ll GUARANTEE that you’ll get ZERO benefit for yourself. As the old saying goes 100% of nothing is still nothing. Get involved, and make a plan with the people you buy with. Will it be a lifetime buy and hold situation, will it be a fix and flip, will it be a hold for a couple years while we wait for the market to recover then sell when things are looking up and move the proceeds into something different situation. There are lots of options and ways to get involved, and that’s the most important part, you can’t win if you’re not playing.

Qualifying Income

The other side that may complicate your grand strategy and push your timeline to purchase real estate is income. I know personally, I do not have anywhere near the income needed to qualify for a home that costs over $1,000,000. On top of that I’m self-employed which means I need a history of making decent money, and will probably have to go to a “B lender” to get my mortgage (and pay them a 1% finders fee). But if I team up with people who have a regular income, we may be able to work something out with a traditional lender and avoid the fee. The important part is figuring out what the collective income required will be with the people you want to purchase the real estate with, or what your personal income needs to be to do so.

Debt Service Ratios

You can also lower the income requirement by increasing the down payment. There are many mortgage affordability calculators that you can use to calculate what the income number will be. The things that factor into the equation are other debts that you have, property tax, heating costs, and half of your monthly condo fees (if a condo). Any monthly payments will bring down the loan you can carry. In banker terms your debts increase your gross debt service ratio (or GDS). Assuming around a 5.5% fixed mortgage rate with minimal other debts. You’d need approximately $220,000 before tax income to qualify for the property. So you can see how income becomes one of the largest hurdles, and why teaming up may be an inevitable route you have to go down.

Partnership

Let’s say that you do team up with two friends, for the sake of this example. The partnerships long-term plan is to own and rent 3 similar properties and pay off the mortgages on all of them in 25 years. Let’s also say for the sake of argument, you’re able to purchase your first property at 25 years old and then at a pace of 1 property every 3 years thereafter. So by 31 you have 33% ownership in 3 properties that are generating around $18,000 in rental income for the group or about $6000 per person BEFORE expenses. Collectively the properties are probably costing you around $1000 a month to carry for the first 5 years. After which you renew into a lower interest rate since rates are coming down (for now).

Final Results & Going Further

In approximately 19 years after turning 31 you’d be generating (remembering our doubling of rent rule), around $4000 a month in rent to yourself, then 6 years later you’d hit your retirement number of $12,000 a month assuming everything goes according to plan. Maybe you’re generating a bit more, and the property maintenance doesn’t have to come out of your pocket. In the end you’d be 56 years old and living off your rental investments. That’s almost 10 years earlier than the stock market example. If you really max out this example, and you try to do bigger and better things. For example, you become a partial investor in many more properties, or take a completely different approach like fixing and flipping in order to speed up your mortgage payments. You can make a TON of progress very quickly and get to your retirement number even faster. But that all depends on your willingness to participate and execute on your plan and find people who can help enable that plan alongside you, or move to a market where it may be possible to do it yourself. Let’s move on to our final scenario.

Method 3: Business Income:

Now that we’ve talked about what I would consider to be the most common ways that people are able to build wealth. Let’s talk about something that is a bit more challenging but can still yield the results that you’re looking for and more. I’d probably consider this to be the most complicated of the options, but it can also be the most lucrative, consistent, and the one that you personally have the most influence and control over. That would be building and owning a business that brings in income for you, without your intervention. The last part of that sentence is key, and also extremely challenging to accomplish.

The “Easy” Method

The internet would have you believe that starting a business is the easiest way to become a millionaire and retire. After being involved in various types of businesses, and speaking to business owners who are working their butts off and cursing their decisions, I can’t disagree more. This is the hard way. The “easy” way (in my opinion, there is no “easy” way, just get used to doing hard things instead) is get a good job, spend less than you make, and ideally save the bulk of your income. Invest it for a long time, then sit back, relax, and watch your nest egg grow. Getting a business up and running successfully on the other hand is a whole other can of worms, and getting a business to run successfully “on it’s own”, is an even bigger ask. But let’s just play with the idea a bit and see what we might be able to come up with.

Creative Industries:

There are various types of “businesses” that could pay you a passive income of sorts, so I’m going to try to bunch categories together. First is creative industries, this involves things like creating music, being an author or publisher, making YouTube videos online, creating and selling classes, even creating a software program or video game. The common thread among these, is that you create something once, and it can be consumed an infinite (or close to infinite) amount of times and you get paid each time that it is consumed. Obviously if you don’t market it and no one knows about it, then you won’t get a single sale. But if you are wiling to put some time and money into marketing these can be quite lucrative.

Not all of these are equal in terms of how much they will pay out, but software is especially lucrative because it can frequently be a higher ticket item, and once the initial R&D costs are paid down, it’s all profit afterwards. Sometimes there are recurring maintenance costs, but these tend to be quite low compared to the income if a product is successful. The problem with these types of industries is largely relevance and marketing, in theory, you can be a one hit wonder that sells and sells and sells until the end of time with no further inputs. But in practice you do have to maintain, upkeep, renew, and refresh as a bare minimum to keep your sales going. But the small amount of upkeep of brand image or what have you can be well worth the rewards.

Franchising:

The next category of business that you might consider going this route is franchising. This can be both from the angle of being the franchisee or the franchisor. This type of model is frequently associated with a fast food business, restaurant, or service business of some kind. Popular examples are Starbucks, McDonalds, 1-800-Got-Junk, etc. The franchisors in these businesses have built up the brand and then systematized it until it is easily replicable, then they can sell business units to franchisee’s who buy in for a certain fee and then operate the business based on the manual created by the franchisor. The franchisor is frequently responsible for the marketing and maintenance of the brand image and keeping things fresh, while the individual franchisees are responsible for operating the business as dictated by the franchisor, sometimes with some flexibility. In exchange for providing a solid brand, marketing, and a “business in a box” to the franchisee, they generally pay the franchisor a royalty fee on all the revenue that the business generates and get to keep the remaining profit after expenses.

The Franchisor

I believe that of the two, being a franchisor is probably the stronger position to hold. If you are the person who builds up the business, the brand, and are selling business units, it is possible to see how all the things you do can be delegated. You hire a board of directors, you get a strong marketing department in place, you hire a business development team to keep your franchisees going and selling new franchises, and you can step away from the top level business. However, this opportunity is also available to the individual franchisees.

The Franchisee

If the franchise owners become adept at managing their business, running their teams and their schedules, there is real opportunity to also step away from the business and put a manager in their place and then replicate this strategy a few times. The big limiting factor in these types of businesses becomes people management and turnover. Managing multiple franchises essentially just becomes an exercise in managing people, so you either need to be really good at doing it yourself, or be willing to shell out the money to hire someone else who is. Being in a people management business is not for everyone, and can be quite time consuming. Some people may prefer the creative industries route simply because managing people is a lot of headache and overhead.

Professional Businesses/Partnerships:

This type of business will deal with things like, doctors, lawyers, engineers, accountants etc. The nice thing about these businesses is that you can set up a practice, build up a client base, and then train someone to take it over for you once you are ready to retire. If you really want to be able to set this up properly you could do it as a partnership and that way if you retire at some point there will be someone else there who may be able to oversee things while you try to find someone else to take your place. The challenge with this type of business is finding a way to transfer over your database of clients to someone on your team and making sure that they treat the relationships you’ve built with all these people the right way.

A Book of Business

Professional business can be hard to sell, but you may be able to sell a book of clients or a database to someone else. I’ve heard in the world of real estate, I believe this may have just been a stolen idea from the world of accounting and law partnerships. But sometimes what real estate agents do is they will sell their “database” of clients to another agent. For example, an older agent that wants to sell their database may sign an agreement with a younger agent for their book of business. Then they create a sort of sliding scale of referral fees for any income that results from this old agents clients.

Buying a Database

For example in the first year any of these clients who the younger agent does a deal with would split the funds with that older agent 50/50. Then each year after that the younger agent gets 10% more of the deals until it hits 90%, then the older agent get 10% in perpetuity, or until a certain number of years has passed, or maybe even until they pass. This is an interesting way to set things up since the incentives are there for both agents. Ideally these clients are transitioned over to the new agent gradually. The new agent may even use some of the old agents branding and marketing style to keep it consistent for the older clients. The old agent may pop in from time to time.

Each year that passes the new agent is somewhat able to grow into the role and earn more. But the hard part, finding clients, is done, and both agents benefit. The older agent is able to retire and get paid out a few referral fees here and there, and the young agent is able to skip ahead a few years and work with a database of well nurtured clients. Maybe there’s even a “sale price” for transferring leadership of the database to the other agent. There’s a variety of ways to set up something like this, but the important thing is that the database of clients doesn’t go to waste and get scooped up by competitors. The person retiring is able to continue to benefit from all the work they did, even if it’s a small amount, and someone new is able to get a jump start on their career. Win-Win.

Other Industries:

There are a ton of other types of businesses and industries that you could involve yourself in, but regardless of what business or industry it is, if you ever want to be an absentee owner of a successful and well oiled business. You will one way or another need rock solid systems and practices in place that allow the machine to run without your inputs. The biggest and most important thing are systems, guidelines, and people who can properly interpret those systems and guidelines and even improve them. This is the dream scenario and requires some amount of letting go of control. Which can be a challenge in and of itself because the people who tend to get to such an esteemed business position usually did so through sheer power of will and force of their personality. Which can very often correlate with having a bit of an ego. Getting that same type of personality to step down from the pedestal they’ve created for themselves and relinquish control, even if there’s no longer any need for them to be captain of the ship, may never happen.

Business Method Final Thoughts

So to answer the question of the post with my final set of examples. In a business, when would you be able to stop saving money? Well if you’re the owner and you’re no longer running the business, you technically just need to be generating enough profit from the business, for it to cover your living expenses. You technically don’t need to save a penny for retirement in this scenario (although I wouldn’t advise that route) if you’re confident that your business will perpetually generate your $12,000 a month. The cool thing about a business is that if you are the type of person to take on a high risk and dump everything back into a business that is clearly beginning to do quite well, you’ll often be rewarded quite well for doing so and this may be the fastest way of the three methods to hit your “no need to save” number. However, businesses undergo cycles so you’d probably be well advised to do some combination of the above 3 things in order to hedge your bets and diversify once you are in a position to do so. But if the hypothetical is exclusively based on the bare minimum amount of money you’d need to save, this scenario can technically be as low as zero.

Concluding Thoughts:

This was a bit of a longer post, in fact so long I spent about a week putting all my thoughts together and made my whole email newsletter a week late. I actually had to cut out a few ideas because the post was really getting a bit out of hand. But I found writing this thought experiment quite interesting. It was a cool way to synthesize the various paths that you can take to become an above average success. It seems to me that most people who are quite successful are almost always doing a combination of all three of the main points that I made, not just one. But at the same time, they usually have a main thing that is bringing in the bulk of their money and the other’s are slowly but surely growing in the background. There is something to be said for really focusing your energy on one thing at a time and putting everything you’ve got into it, before moving that energy around to other projects. Focusing and doing hard things every day for a long time are what yield real results. Thank you for reading and as always.

Keep Investing,

-Oliver Foote