What in the World?

Well, I think we have all heard quite enough of the word “Tariff” these days, what happened to duties, or just taxes? Also, we would be at least 10 states, if not 13.

Backstory:

If you are reading this in the future, you may have no idea what I am alluding to. Tis the year 2025, May hath just begun and methinks I have heard the dastardly word “Tariff” more than one thought ever possible. Canada’s federal liberal party had possibly the quickest U-Turn to an election victory in history; everyone thought they had no chance just a few months ago. The guy running the US is convinced Canada should be “the 51st state”, among about 500 other things. What a weird timeline. I think in 10 or 20 years we will all look back on this and be very confused. At least I hope that is the case and all the world’s problems are solved, one can at least dream. For now, this is the world we live in and there are some pressing problems facing Canada and the new Prime Minister.

Mark Carney:

Arguably one of the best moves of Trudeau’s political career was knowing when to bow out. The new leader of the Liberal Party Mark Carney really appeared to come out of nowhere and swept the liberal leadership race becoming the new prime minister, then quickly called a snap election to solidify his position for the next 4 years. Looking at his resume he has been quite involved in government prior to this. Working with a what was almost certainly a defeated liberal party just months ago, he managed to come within 3 seats of a majority government. With the new US leadership and Tariff policies we are all getting a crash course and re-learning that the links between the Canadian and US economies run deep and trade policy is very important to not only the price of goods, but consumer confidence in spending money and retaining jobs. While I would love to chat about everything, my main focus is going to be talking about what plans Mark Carney has for Canada and what the future might look like if he is able to follow through on some of his election promises. A lot of the points he was touting on the campaign trail I have addressed as problems in my prior posts. Things such as the need for better trades education, lowering cost of housing, and more investment and innovation in Canada. I have also made some videos to go alongside those conversations which you can find at youtube.com/oliverfoote. Now, let us dive into the promises and what some of the outcomes might be.

One Economy:

This is an idea that has come up ever since the start of the trade war. The idea of “one Canadian economy”. Canada is made up of 10 Provinces and 3 Territories and many have local industries they try to protect, through methods such as non-compatible worker credentials, export restrictions of certain goods to other provinces, and a general higher willingness to trade with the US than ship across this massive country (understandably). Many of the provinces are on board with the idea of demolishing some of these barriers and now that there is the political will to find a way to remove them largely thanks to Trump’s trade war, I think it is likely that this will get done between Carney and the premiers. There have been some numbers quoted that if we are able to do this it would return around the same amount of economic activity to Canada as a 25% tariff from the US would cost Canada. I am of the belief that pretty much everyone is in agreement that more labour mobility, easier flow of goods, and accepting credentials across provinces is just a sensible thing to do, would improve workers ability to move to better opportunity increasing competition and wages in the labour market, filling worker gaps across provinces which could also help bring costs down in some industries. This could help provinces that need workers, and provinces that have an oversupply of workers balance out their supply dynamics a bit. We have already seen an outflow of people from provinces like Ontario to provinces like Alberta and the Maritimes. The idea would be a win-win, takes pressure off for example Ontario’s employment and housing and provides much needed workers to places that are having a hard time finding them; if people are willing to move across country of course.

Build Baby Build:

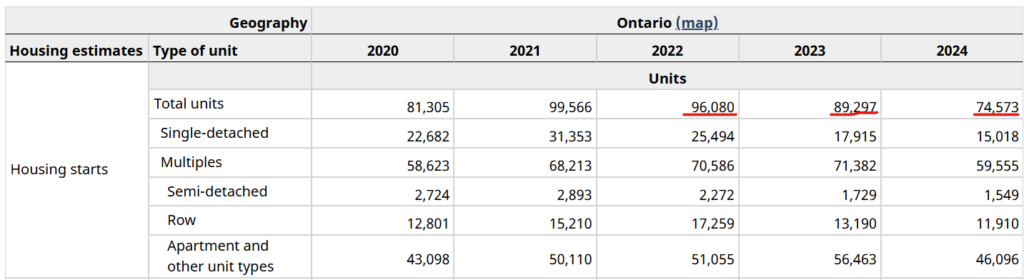

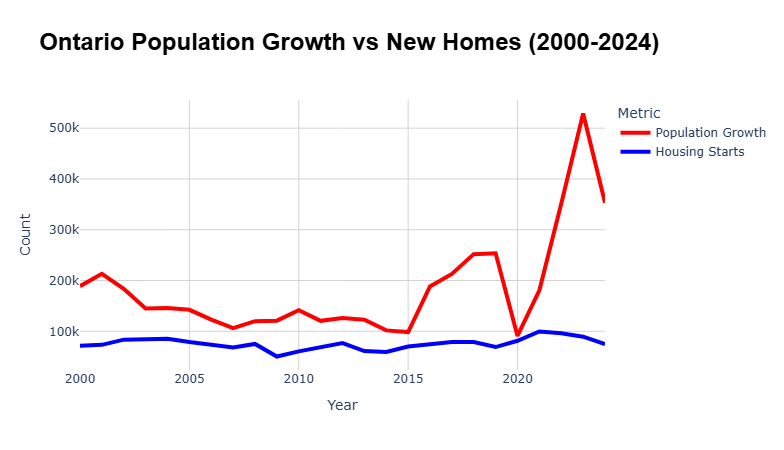

There was one line that stood out to me on housing and that was when Carney said, “we need to build homes on a scale not seen since the Second World War”. The outline of how they plan to accomplish this is multi-layered, but in essence the plan is to create a new government agency with the goal of investing in new home building technology, providing low-cost financing for affordable units, tax incentives for multi-residential unit construction and conversions, and importantly cutting governmental charges on building homes. Of all the costs of construction, (mostly) municipal-government development charges have gone up the most in percentage terms of any development cost in the past 20 years, for a variety of reasons there are a few very interesting videos done by YouTuber “About Here” covering this topic in detail. The liberal government claims on their website that cutting development costs in half will spur $8 Billion of private investment (every year!). We will bookmark that and see how it pans out 5 years from now. They also claim they will work with cities to speed up approvals and try to systematize credentials across Canada so builders can work anywhere, again I think this is a positive thing. Toronto has one of the worst approval timelines in North America at around 30 months, that is just the approval stage! The actual construction of a high rise takes about 2-3 years, but the approvals and delays add 7 years on average to that timeline. Therefore, if we can cut down these delays caused by zoning and city approvals by half, it would immensely improve affordability as every delay adds cost to the price of the end unit. My hope is that provincial and municipal governments across Canada can get on board with the federal government, simplify their processes, standardize approvals, and start rubber stamping thousands more units per year.

Innovation and Investment:

I heard a business owner once say and I think this goes for builders and housing developers, that they are running their businesses in Canada “in spite of” the local government, not because of it. I believe strongly that government has a role to play, making sure workers are safe, making sure that monopolies are not stamping out competition, supporting and championing local businesses. I believe that all levels of government should work hard to be partners with business, not roadblocks. This is where a line from the liberal platform comes in, they said “[lets change] why are we doing this” to “how can we get this done”.

When it comes to housing, when it comes to business, when it comes to trades, innovation and re-investment, we really need to start asking how we can enable things to happen, not why they should or shouldn’t be allowed in the first place. I have made videos and written about Canada’s declining business investments in the past and how a lot of our private sector business investments have moved into the residential housing sector and inflated residential asset prices. This has been somewhat of a trend across many western countries. The liberal platform addresses this as well and points to specific plans for increasing investment in Canadian companies and businesses. I read a very interesting working paper from the Bank of Canada that is related to this. They discuss global capital flows and how money historically flows to the US and their huge “Superstar” firms, which also tend to attract global talent. Canada has a bit of a history with tech firms imploding, think Blackberry and Nortel, but this is not an excuse to not compete at all. Canada needs to invest and encourage a greater start-up and entrepreneurial culture that can potentially create some of these global superstar competitors that will make Canada a more attractive place for global capital, talent, and diversify our economy. Naturally, at some point every company will expand internationally, and finding success in the US is the ultimate victory because of the liquidity of financial markets, start-up culture, the tendency of the American consumer to spend their money, all help companies to grow exponentially. I believe there is more room on the world stage for Canada to innovate at a greater pace and be more than just America’s little brother.

The Future of Canada

There is so much to talk about here and the layers go very deep. I am unsure of how much the Carney government will be able to accomplish, but I do hope that at least some of their ideas make it through. As a nation we have reached a point in time where everyone is in a very patriotic mood and seems very willing to resolve some of these bigger political issues and people are united in the idea of doing so. I hope that this new government can jump on this moment and that this can be a catalyst towards Canada become a larger player on the world stage once again. If there has even been a moment in time where the country and all levels of government seem willing to make massive changes, it’s right now. Amidst all the chaos of the past 5 years, first COVID, now a trade war with very clear signs of recession looming, I find myself feeling optimistic about what the future of Canada might hold. I no longer feel this imminent urge to pack my bags and leave for better opportunities elsewhere in the world, but if one presents itself, I will still likely make the jump if only for the experience of having done so. Only time will tell what ends up happening, but I have a lot more hope than I did a few months ago. There will be a lot of bumps in the road along the way but I am willing to give this new government a chance to see what they can do.

-Oliver