Update Dec 14, 2024: Added Newsletter Email Archive at End of Post.

Why People Invest in Commercial

The commercial real estate rabbit hole is never ending. Depending on the situation commercial real estate can also provide better returns than residential real estate partly due to the fact that commercial real estate out the gate is viewed as an investment with a profit motive. Therefore, the only other people you are likely going to be competing against are other investors. Whereas investing in residential is a bit different because you are also competing with people who view it as a place to live not just a way to make money. Therefore, they may be willing to pay more in order to get what they want, meanwhile investors generally speaking are looking for a great deal, a high ROI, and may have a shorter timeline than someone who plans to live in their home for years. The owner/occupant might view paying a premium as a small price to pay for a great house they’ll live in long term.

Does Multi-Family Count as Commercial?

Before diving into the various categories of commercial real estate and the pros and cons of each and what to consider before investing. I want to talk about a category of commercial real estate that is sort of in-between commercial and residential, and that is multi-family commercial. Multi-family commercial is generally 6 or more units, this category of commercial also tends to be competitive with respect purchase prices. In larger cities cap rates (I’ll explain this in a minute) tend to be lower because if there is demand for rental units (e.g. big city = demand), the investment will provide a fairly consistent return without much vacancy or lost rent. Many investors who started out purchasing residential real estate as an investment will frequently work their way up to multi-family apartment buildings once they have the funds to do so, and may even get into construction and development or re-development.

More Competition in Multi-Family Space

However, as mentioned, there can still be quite a bit of competition for these kinds of investments. Although not as much as a typical residential home. On a quick tangent here, in the Greater Toronto Area multi-family investments are becoming harder and harder to find because we simply aren’t building purpose-built rentals anymore (another name for multi-family). In an attempt to make everyone feel like an owner, we have been building almost exclusively condo apartments, which tend to come with high costs, unnecessary expenses, and don’t tend to be all that affordable. Therefore, the price of purpose built rentals as investments have gone up (as have rents) in larger cities. In an attempt to alleviate some of the stress from underbuilding purpose built rentals are conversions of larger homes to 3+ units. This has become very easy to do thanks to recent changes in housing regulations, up to 4 units on a single lot. This presents opportunities for investors who have some skill in construction management, but they may still find it challenging to make the investment work due to the sheer amount of competition from owner/occupants who also want to purchase those homes. However, the amount of converted homes will likely increase over time as investors become more adept at doing conversions and homeowners themselves begin to add additional suites. This could also make these homes become worth even more thanks to the extra income, everyone seems to want an “in-law” suite. So the regulations could really benefit the investors or owners who are able to purchase and upgrade their homes which could benefit supply. But overall we won’t be able to exclusively rely on this method of adding housing supply as it really is a small drop in the bucket compared to building purpose built rental apartments like we did back in the 70s and 80s. Ok, now back to what you came for, talking about other kinds of commercial real estate.

Offices and The Pandemic

Firstly, lets discuss office buildings. If you’ve been following the news in the past 3 years or so we had a small little pandemic. The effects of the work from home shifts that were caused due to the pandemic, meant that a lot of office spaces were sitting vacant for a long period of time. Workers and companies moved to a hybrid model. Then all of a sudden they didn’t need as much space as before. Even the most expensive, sought after real estate 1 World Trade Center in Manhattan had some of it’s tenants downsize and sublease their rentals because they weren’t using the space anymore. The effects for smaller landlords in smaller cities were more significant. From an investors perspective, the high vacancy that office real estate has seen presents a big risk, if you choose to invest, you could face long vacancies and it could hurt your profitability, or ability to pay the bills. However, where there are problems there is also opportunity. Because of the high vacancy rates, you could purchase a “distressed” asset at a very good price (whatever that means in your market), and then come up with a plan to change its use, or change the type of professionals that you cater to. I’ve heard of people renovating their buildings and turning them into co-working spaces, residential apartment buildings (can be a big investment since fire code regulations tend to be different when kitchens and sleeping are involved) and various other conversions. I’m sure you’ve seen some of those old industrial buildings that get converted into extra high ceiling apartments with a rustic feel, generally called lofts, although people can be pretty loose with that term nowadays. But for the right person, and for the creative investor, an investment in office real estate right now presents a TON of opportunity.

Get Your Starbucks Out for Retail

Secondly, what about retail. Now that’s something you don’t think about. But yes, someone (or usually a company) owns shopping malls. Generally those large individual businesses that occupy them don’t own the real estate. They rent out the space as do other various businesses and due to a good location, or modern amenities or what have you, businesses lease the space and try to turn a profit of their own. Investing in retail real estate can be quite a bit more involved and may also require more scrutiny on what types of tenants you want and the tenant mix you are looking for. As an investor in retail, you have to take a different approach and you almost have to view the space you are leasing as a partnership with the businesses that will occupy them. Likewise, if your retail space is subpar, a tenant may choose not to rent there because they may be worried about the sustainability of their business. Both landlord and tenant in a retail situation benefit from a few main components. Traffic through the area. Are there lots of people? Are residences being built nearby? Is there a highway that people often pull off from? Are there any “anchor” tenants: these are tenants like your Walmarts, Tim Hortons, Starbucks, Big Grocery Stores etc. which drive traffic to the area. If you can get good anchor tenants, this may also attract other tenants to the area. Anchor tenants tend to have more bargaining power due to the fact that they will likely contribute a significant portion of the traffic. Economic forces are also a factor, if we look at the pandemic again there was a time and there were many businesses who went out of business because they were either unable or not allowed to operate their in-person stores. This is unlikely to happen again, but people’s expectations have changed and if businesses aren’t changing in line with expectations they could become irrelevant before long.

Light Industrial: Warehouses etc.

Thirdly, probably the most complicated form of investment in real estate, light and heavy industrial. Light industrial is a bit easier to manage, but may still require special considerations. Light industrial involves things like warehousing, small time manufacturing, and other types of businesses that involve warehouses to some degree. This could just be a kitchen, bath, tile warehouse, Costco and IKEA could both fall under light industrial, but since they are also retail it might be sort of complicated to categorize. Depending on the type of tenants that are interested in renting out this real estate you may have to make certain adaptations to the property, or the tenant may request adding more power or maybe a ceiling crane, or other larger things that are used in warehousing. In some ways this type of real estate can be easier to manage, but because every tenant will likely have different requirements you may end up spending a lot of time with engineers to see if the property can be adapted to what they are proposing.

Heavy Industrial: Probably Irrelevant for You

Heavy industrial on the other hand is extremely specialist, and frequently the companies involved in this type of work will just buy the land themselves when possible. This involves things like chemical plants, oil refineries, car manufacturing facilities etc. The big consideration for investors who are thinking about buying land that was previously used as a manufacturing facility is environmental concerns. Land has to pass multiple layers of inspections by the EPA (Environmental Protection Agency) here in Ontario. Often they will require remediation of the land before it can be used again or the land can be sold and remediation costs can go from hundreds of thousands to millions of dollars depending on the damage and requirements of the EPA. So once you start getting into industrial, environmental issues become more of a concern. On a smaller scale it is important to keep in mind environmental concerns when you are purchasing ANY commercial real estate that was either on or around a gas station, a mechanic shop, dry cleaner, certain farming operations, or any other business that heavily uses chemicals. You don’t want to find out when it’s too late that you have to remediate land. So it’s always advisable to research what prior businesses were nearby and to put in a clause to get the land inspected by the EPA prior to agreeing to purchase it. Next I’ll dive into what to do after purchasing land, and how commercial leases differ from residential.

The Commercial Property Lease vs. Residential

With all the examples of commercial real estate above we should talk about leases, since they can be quite different than what a residential investor is used to. First of all, the minimum lease term is generally 5 years with 10 year leases also being common. The screening for commercial leases tends to be more intense, since landlords are expecting the tenant to survive at least 5 years if not longer. The landlord will frequently pass on all the operating expenses of the building. But the tenant may also be able to negotiate that the landlord pitch in on some renovations to get their business operating quicker. There are all kinds of technical terms for commercial leases, generally a triple net lease (or net net net lease) is one where the tenant covers all expenses including large ones such as roof repairs, property taxes, snow maintenance etc. A single net lease (or net lease) is one where the tenant is responsible for it’s portion of utilities and the landlord takes care of the building etc. There is also double net leases, but these terms are somewhat loose and each agreement will be different.

Additionally, in most leases the tenant is able to make whatever renovations they want to a unit, there may be a stipulation that they have to return it to a certain state when they move out. But any renovations are usually the tenants responsibility (unlike in residential where the landlord renovates units for the tenants). Furthermore, there is no such thing as a “standard lease” in commercial real estate, the way that there is in residential. This means that generally a landlord can put whatever conditions they want in a lease, so it is important to read it in detail and have a lawyer review it.

Calculating Rent and Realtor Fees

Note that the realtor fee tends to be a percentage of the total lease which is usually the landlords responsibility to pay. I should also mention that if you are looking to rent commercial space, you will likely have noticed that the way the lease price is presented is quite different from residential. Rather than a per month amount, the price is per square foot. For premium downtown Toronto office real estate (Class A buildings) you may be looking at $40 per square foot, for suburbs it might be closer to $20 per square foot. Just as an example, lets say the space you want to rent is 1000 sq ft offered at $20 per square foot. When you multiply the numbers you get $20,000. That $20,000 would be the annual rent plus any other additional fees agreed to by the landlord and tenant. Each year, the price may change. So in year 1 it might be $20 PSF, then by year 5 it may go up to $25 PSF.

Calculating Square Footage, Useable vs. Non-Useable

Commercial real estate is also a bit strange in some ways because a portion of the common area may count towards the total sq ft that you are renting, this is usually the landlords responsibility to take care of for all the tenants in the building. But it won’t be useable sq ft for operating your business. So you need to make sure if you require a certain amount of useable space that you confirm and measure the space yourself and figure out how much of the sq ft the landlord is asking you to rent is common area square footage. This extra square footage may change your willingness to rent a certain space or to pay a certain price for that space. The idea for renting “non-useable” space is that it’s a nice lobby area for clients to wait in, or its a foyer that makes the building look nice at the street level, and it’s a value add to your business. Some businesses may see it as a value add, others may not.

Capitalization Rate or Cap Rates:

You’ll probably hear cap rate about a million times when you’re looking at commercial real estate as an investment. Essentially a cap rate is what the market requires the property to generate as a return on investment and determines the property value (most of it anyway). For multi-family residential in Downtown Toronto for example a 4-5% cap rate would be considered good. For example, lets say my multi-family building generates $80,000 net of expenses each year (operating income). Let’s also say the generally accepted cap rate in the area is 5%. You take the 80000/0.05 = 1,600,000 is the value of the property. Alternatively, let’s say someone is asking 2,000,000 for a property that generates 90,000 of income. You can find the cap rate by dividing 90,000/2,000,000 = 0.045. So the cap rate is 4.5% for this property.

Analyzing Your Commercial Investment

You do have to be careful when you are investigating a property since naturally the owner will do whatever they can to make it look as good as possible. Owners should have documents of all the expenses of managing the property as well as the rent rolls and vacancies of the property. Sometimes, they don’t and you’ll just get a bunch of estimates. Regardless, it’s important to do your own research and make your own estimations of how much the expenses would cost. Are there some changes, investments, or upgrades that you can make which will improve the cap rate of the property after purchasing? What are the opportunities available that the previous owner didn’t bother to take advantage of? This type of thinking is essential to making a good investment, because usually the market price of a property and the potential of that property can be quite different. It is also frequently the case that the current rents of the property will not cover the cost of financing so to make the investment work you will have to think creatively.

Internal Rate of Return (IRR) and Net Present Value (NPV)

There are other metrics that investors use as well, such as IRR, or internal rate of return, this takes the investments cash flows, purchase and sale price over a longer time horizon and gives an expected rate of return. Sometimes investors will go into an investment with the expectation of a certain IRR. If the investment meets the IRR, then they will go ahead, if not, they will pass. IRR is frequently used as a discount rate in calculating another number called the net present value (NPV). NPV is a way to discount future cash flows factoring in a discount rate. The discount rate, can be based on many things, generally the risk free rate (the rate that government bonds are paying) plus some other factors such as mortgage rates (the value you could get lending the money to someone else) and inflation (time value of money) are taken into account. Using a formula all the expected future cash flows are discounted using the discount rate and they yield a dollar amount. If the dollar amount is negative factoring in the discounted cash flows, this means that the investment will likely be worse than an equivalent risk free investment. If the value is positive it means the investment is better than a risk free investment (or it meets the investors required IRR). Generally the rule of thumb is that NPV has to be zero or higher to move forward with an investment. My explanation is not great, but I do have a video that does a better job explaining these things below, if you’re ready to dive into the technical weeds:

Property Management, Systems, and Employees

Lastly, what about management? Depending on how you set up your rentals you may need to hire an admin staff to manage it, cleaners to keep common areas or business offices in tip top shape, and have some tradespeople you trust to fix things when they break. As you build up a portfolio it might make sense to hire a property manager who manages everything. From finding new tenants to hiring the tradespeople and cleaners. For almost all types of real estate investing once you get to a certain level, property management becomes very important. There are property management companies which provide the service for a fee (usually around 10-20% of rent). This might make sense for you if you have one or two properties. But if you have a larger portfolio there comes a time where it makes sense to hire an employee to do this for you.

If you choose to go down this route, you’d be well advise to have a handbook that has phone numbers of tradespeople you trust, and step-by-step approaches on what to do in certain situations (or “systems”). It will be a lot of work, and you’ll learn as you go, but having a “run my life manual” can be extremely helpful for the people that work for you, and saves you the headache of having to approve a small expense, or screen every tenant, or deal with every small leak or lightbulb. I think building out this type of “systems” or “operations” manual early on is a very good idea, that way when you hire someone, or an employee leaves, you aren’t left hanging with no direction to give this person. Obviously, some situations are different but you can get as low level as you want, including the types of brands you trust or don’t trust when replacing broken components. Building something like this will make your life much easier before you hire someone, and will make the employees life easier when you eventually do.

Why Commercial is Worth it (Conclusion)

In conclusion, believe it or not this was a very brief and very light overview of how investing in commercial real estate works. The goal of my post was just to get you thinking about it and to somewhat de-mystify it. A lot of people will never invest in commercial real estate, or don’t even think about it, but it is frequently a better investment than residential real estate. But as with any thing that provides a higher return there is higher risk. It’s very mainstream to invest in residential real estate nowadays. The barrier to entry for commercial is a bit higher, and usually when there is a higher hurdle to jump over, that is the opportunity you should chase because it will keep your competition out. Simply by the fact that it’s a bit more challenging. Residential is quite frankly oversaturated with investors and the gaps in the market are very slim to the point where the only way to make those investments work now is to take on a lot more risk and oftentimes without a suitable upside.

No matter how you swing it nowadays, getting a profitable investment is going to take some work, and I hope that by bringing your attention to commercial real estate investing you might be interested in learning more about it. If you do I would highly recommend the b real estate podcast, they have a ton of episodes talking about commercial real estate, it is American so some of the rules will be different to Canadian rules. But just getting an understanding of the various ways people get creative with their investments is a huge leg up on the competition. Additionally, I would recommend talking to someone who is a commercial real estate owner and investor, they can be a bit harder to find, and I would recommend trying to find someone who is still active in their investments because they will likely have had to face recent hurdles that will be helpful to learn from in todays market. I’m also certain that there are Canadian real estate podcasts out there which have episodes talking to investors and they’re definitely worth checking out as well. As my final word of parting, if you do nothing else, you should just get started. People spend way too much time (myself included) over researching and reading for months or years without taking any action. Preparation is good, but don’t forget to put the things you learn to work! Thank you for reading and as always.

Keep investing,

Oliver Foote

Newsletter #20: Investing in Commercial Real Estate, Fall Real Estate Market Expectations

This Weeks Blog Post:

Investing in Commercial Real Estate: Retail, Offices, Industrial, & Multi-Family:

- Why people invest in commercial real estate

- What the various types of commercial real estate differ

- How to calculate commercial real estate numbers, why to think about investing in commercial

Read the full article here: https://oliverfoote.ca/investing-in-variety-of-commercial-real-estate/

Real Estate News:

- Hopefully everyone has enjoyed their summers, it’s crazy how quickly they went and how quick September is looming just around the corner. I hope that you were able to have some fun this summer and that you’re feeling refreshed from some time off.

- Last months TRREB numbers showed that the current interest rate cuts were not having a significant impact in buyer activity. I believe that this trend will continue and that it will take some more rate cuts for first time buyers to get back into the market. There is a lot of supply on the market and it will continue to build up this September. There is another rate decision coming September 4 and I’m inclined to think that the bank of Canada will want to cut rates again. Employment numbers are continuing to be lackluster here and in the US and this gives reason to me to continue bringing rates down.

- Business growth on the whole is currently sitting in a “maintain” state as many buyers for discretionary services or businesses are cutting back causing the overall demand of the market to drop. So if you are in business and are maintaining your revenue numbers right now, you are probably gaining market share on the whole since the size of the market is shrinking.

- Just hearing through the grapevine, the employment situation is a bit worse than the numbers would make it seem. People are continuing to get laid off from their jobs as companies are still trying to focus on efficiency at lower cost. Some positive trends are that net food prices (after sales) are continuing to come down. Gasoline prices seem to have stabilized and rent prices appear to also be stable or dropping in some places. Simply because we aren’t formally in a recession doesn’t paint the whole picture. Life has become a lot harder for a lot of people, and everyone is somewhat worried and not spending money like the crazy spending we saw during the pandemic. The “stress” on the economy is being felt by everyone.

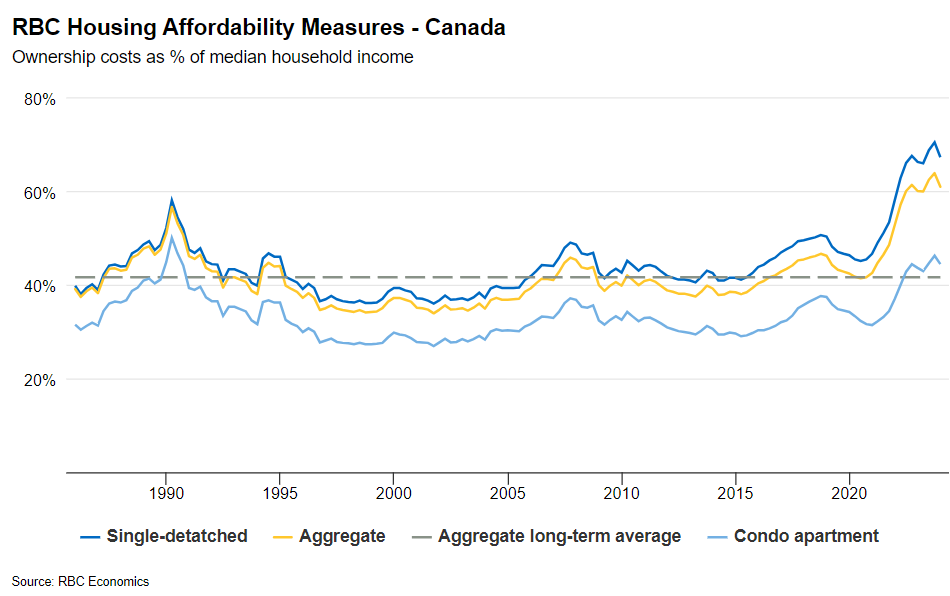

- One of my favourite charts to judge the state of housing affordability is this chart from RBC, this was published July 4, 2024, and shows a very moderate improvement in housing affordability. But it is still considered quite unaffordable for most, which again points to more rate cuts from that perspective.

Stock Market:

- Lastly, 2 weeks ago I wrote about how employment numbers in the US caused a dip in the stock market, and how I said it was likely very temporary. Well two weeks later we’re right back to where we were before the dip. Quite short lived.

NEW Podcast and Video Newsletter Formats!

Spotify Podcast: https://open.spotify.com/show/1qOW97Q9EbTP3J9nkVJmg6?si=13b5d205d9f743d8

YouTube Playlist: https://www.youtube.com/playlist?list=PLwp9y_xXhrypMPhTAGPvHd6Nl72IS-lBA

Market Performance as of close Tuesday August 20, 2024:

S&P 500: 5,613.62 (+18.38% YTD)

NASDAQ: 17,878.35 (+21.08% YTD)

S&P/TSX Composite: 23,069.22 (+10.53% YTD)

Canada CPI Inflation June 2024: 2.7% (0.2% Decrease from May 2024)

Current BoC Benchmark Interest Rate: 4.50% (0.25% Decrease on July 24, 2024)

Unemployment Rate June 2024: 6.4% (0.2% Increase from May 2023)

Subscribe to our newsletter!