Newsletter 30– Jan 29, 2025

Who’s Making All the Money?

This idea came back to my mind because I heard in the news that the Toronto Real Estate Board saw a decrease in membership for the first time in 20 years. The real estate business was becoming a lot harder for a lot more people. The number of sales from the peak crazy year 2021 has been cut in half, which means literally half as much to go around. So this post is going to be a bit of an analysis about this problem, as well as talking about which realtors are able to continue doing this over the long term compared to those who are leaving the business. I also want to throw in a bit of my own story here, because I’m learning that being a Realtor is much harder than the successful people make it look.

The Famous # of Sales Chart:

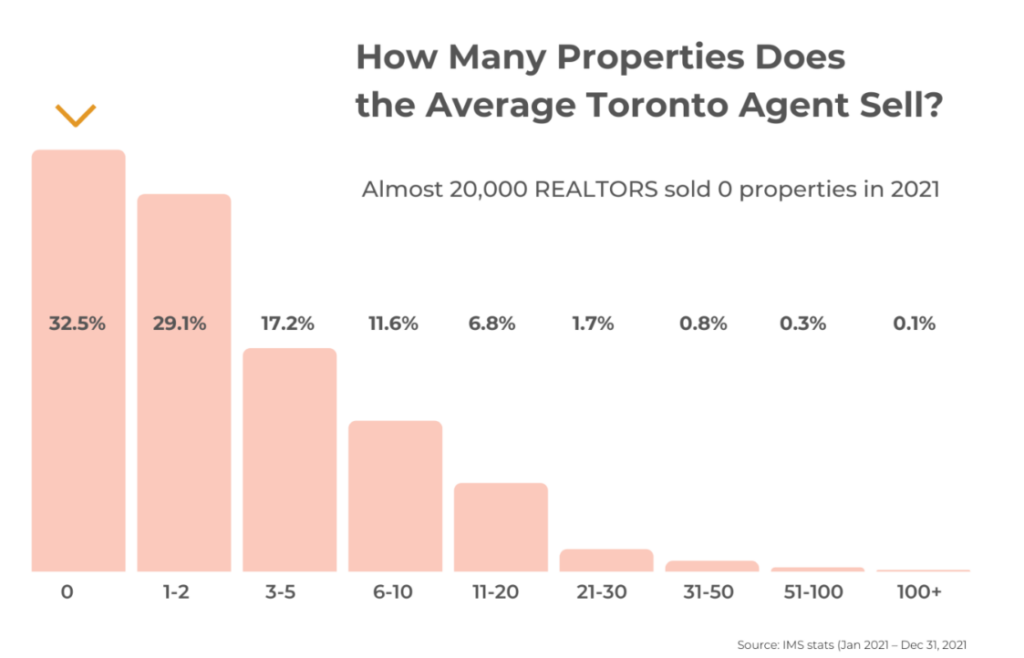

This is a topic that if you’ve ever looked into the real estate industry you’ll know comes up time and time again. I’m going to use the area I work in, Toronto, as the case study, but I’m almost certain if you look anywhere else in Canada or the US you’ll find the exact same thing. Here’s a chart talking about the number of home sales each Realtor made in the Greater Toronto Area in 2021.

In 2021 it was a record year for home sales in Toronto with the Covid vaccine being distributed and the interest rates so low to stimulate the economy. 121,000 sales were recorded, which we can assume for simplicity that each had 2 agents on either side. This means a total of 242,000 transactions were completed.

As the chart helpfully points out 32.5% of realtors made ZERO sales. Which is a TON of Realtors. I’ll get into the numbers a bit later, but doing ZERO sales means that the decision to be a realtor is costing people. From my own lived experience, I’ve averaged around $7,000 in random licensing fees, desk fees at my brokerage, and misc fees, just to stay licensed and run my business. Which quite honestly I do very cheaply compared to the marketing spend of some other Realtors. I know there are cheaper ways to stay licensed than what I’m doing, for example going with discount brokerages. But it would still run me probably around $3,000 a year bare minimum to stay licensed. Which isn’t an insignificant amount of money.

Looking at some more stats. The average home price in the GTA at the time was around 1.2 million dollars. Assuming an average commission of 2% after brokerage splits, fees, and expenses for listing a home and sharing a commission with another agent. The net income on a sale per side would have been around $24,000. In my opinion, this means that you’d need to be making around 3+ sales per year in order to survive in the business, considering all the other fees and targeting the median income of around $60,000. Doing 3 sales and having a net income of $60,000, is a pretty nice deal, but I’ve also learned that it’s not something everyone is capable of doing. As evidenced by the chart, the competition is stiff, and the few winners really take the lions share in this business. The top 10% of realtors do almost all of the business while the other 90% are picking up scraps by comparison. So what makes these top 10% or top 1% so special?

Visibility Trumps Ability:

Going back to the chart for a second, you’ll see that based on my rough math on 3 sales, about 50% of realtors are making barely enough to get by or not getting by at all. So what are they doing? Are half of realtors working part-time? Are they delusional? What’s going on? I think it’s a bit of everything above. Many people who are doing less than 3 sales per year are probably doing it part time, maybe they only sell their own properties, or they just aren’t cut out for the competition. They my also just be unwilling to spend money to market themselves, which as you’ll see below. Is quite an important thing to do.

I think there should be a big disclaimer before people enter the real estate industry that they need to budget around $10,000-20,000/year or more just to dedicate towards a marketing campaign. This might seem like a lot of money to someone just starting out. But I can tell you from what I’ve seen working on a team the amount of time, money, and effort it takes to really take this career seriously. If you aren’t willing to invest either an enormous amount of time or money in marketing, you will likely die a slow painful death in this industry along with the 90% of agents who do less than 10 sales a year.

Most Sellers Sell With The First Agent They Call:

Real estate is an industry of visibility. There have been stats and datapoints showing that most people only know the names of 2 or 3 realtors off the top of their head. When they go to sell their home, most homeowners only interview 1 realtor (per National Association of Realtors in the US). What this means is that you have to be the first Realtor who comes to mind for a homeowner. But most homeowners only sell once per 7 years. So if you want to be doing lots of business, you need to be the first that comes to mind in hundreds, if not thousands of people’s minds. If you are able to accomplish this you’ll likely be one of, if not the only one potential sellers will call to list their house. You can be a complete dunce, an arsehole, rude, etc. BUT, as long as people know your name, and you’re the first one they call. You’ll likely do more than ok in the real estate business.

Selling Agents Rule The Business:

Another important thing to note is that most if not all of the Realtors who are in the top 1% bubble, are primarily selling agents. Listing homes also happens to be one of the only ways that this business is sustainable long-term. The reason is simple to see. In most markets, but especially hot markets, being a listing agent trumps being a buying agent any day of the week. In a market where there is a ton of competition, and say for example there are 15 offers on a property and the sale numbers are going insane. Only 1 of the buyer agents will earn a commission, and the other 14 agents will have to continue to show their clients properties. It may take them 10-20 or more listings until they earn a commission. If the buyers agent is really unlucky or the buyers aren’t very motivated, they might have spent months or years with clients and never make a sale. However, as the selling agent, you’re almost guaranteed to earn a commission from your listing in a hot market. Obviously, some sellers have unrealistic expectations, may be unmotivated, or the house might not sell for various other reasons.

Even in a cold market, as the selling agent, you still have the advantage. You aren’t worried about scheduling appointments, or doing x number of showings per week in order to try and find something your clients like. You make sure to present the property well, take good photos, set a good price, work with your sellers, and wait for other agents to bring you offers and you negotiate for your clients. As a listing agent it’s feasible to have 20 listings up at a time. Buyers agents will show your listings to their buyers, that’s like having an army of people working for you to get the house sold. But once you’ve staged, listed, and marketed the property on all the usual channels, as a Listing Agent it becomes a waiting game, rather than a chasing game, and you can spend your time seeking other listings. Meanwhile, as a buying agent it is almost impossible to show 20 properties in a day and even if your clients do find one that they like, you may get beat out by other buyers or the seller may be unwilling to sell, and you have to keep on keeping on. Being a buying agent simply does not scale beyond a certain point.

What’s holding Agents back?

I’m sure you’ve heard stories of people who enter the business and immediately are making tons of money and tons of sales. How are they doing it? The simple answer is that they are probably much more willing to spend money and take risks than your average realtor. They probably have a pre-existing network of people that already know and trust them and have good relationships with. They’re also probably a competitive person. Lastly, they understand that the name of the game in real estate is selling and put their time and energy into becoming a selling agent not a buying agent. Which is why almost every single real estate billboard you see talks about how “I’ll sell your home in x days!”, or “Our listings sell x% above market average”, or one I really like, “top 10 things to do when selling your home. 1. Call me. I’ll handle the other 9.” All of these Realtors with these big marketing campaigns know that selling is the way to go. Side benefit, you might get a few buyers calling you as well. No reason to turn down business.

Concluding Thoughts:

I think we can surmise that the 50% of agents who aren’t surviving are likely missing one of the key components I mentioned. Likely, they aren’t willing to put in the time or the money that is required to become the top agent that people will think to call when they sell their homes. They probably aren’t thinking long term about the business model and what is sustainable. I think a lot of agents may also be scared of trying to list a home. From experience I know that it can seem like a daunting task to get a home picture ready and staged properly, you’ll likely have to put in some money up front to do it the right way as well, with the possibility you don’t see a penny of that money ever again. But it’s important to realize that if you’re unwilling to learn how to be a listing agent, you should probably exit stage left before you go broke. You’re competing for peanuts with the 90%, not the big prizes with the top 10%.

That’s going to do it for now, this post is a bit more brief than usual. I originally wanted to discuss a bit more about my own finances. TL;DR: I’ve discovered that between owning a car and being a realtor I’m burning around $14,500 per year. I’m not sure how relevant the discussion about my personal life goals and finances would be to this blog. But I’ll just leave you with this thought. Owning a car is not a good financial decision, unless it makes you much more money than it costs you. Being a realtor who does less than 3 sales a year and doesn’t have a business plan that leads to being a listing agent is also not a good financial decision. In order to be a Realtor you almost certainly need a car. Meaning that owning a car solely to be a Realtor, can be a VERY bad financial decision if you’re not serious. Thanks for reading, hope you found it interesting or useful. As always.

Keep Investing,

Oliver Foote

Subheading: The blog this week is discussing: “Why are most Realtors broke?” You may have heard about why some Realtors perform better than others. There are some fundamental reasons, and I discuss what those are in the post. Also BoC cut rates by 0.25bps! Will this help buyers? Certainly should.

This Weeks Blog Post:

Why Are Most Realtors Broke?:

- The question, should you list homes or should you help buyers?

- Why some Realtors do better and outcompete others.

- The crazy cost of Realtor fees, just for the privilege of being an agent.

- And more…

Read the full article here: https://oliverfoote.ca/why-are-so-many-realtors-broke/

Market News:

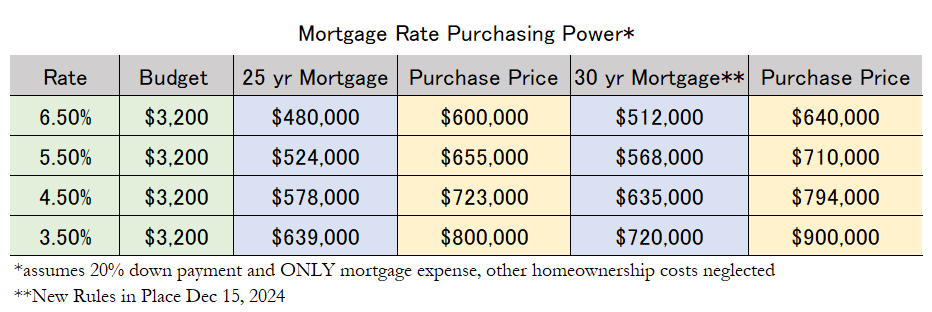

- The Bank of Canada cut interest rates on Wednesday Jan 29th. This means that the overnight lending rate now sits at 3%. For us normies, that means that the prime lending rate at banks is now at 5.2%. With some banks offering prime – 0.3% on 5 year variable rate mortgages. That puts the mortgage at 4.9%. The 5 year bond yield, which determines fixed rate mortgages, is sitting at 2.8%, which is nearing a 52-week low. You’ll likely start to see 5-year fixed rate mortgage below 4.5%, with some as low as 4.2%. If yields drop enough to the point where we start to see a leading 3 on mortgage interest rates, I believe this will be a psychological breaking point and people will return to the market in droves. Potentially just in time for the seasonally hotter Spring market. If yields continue to fluctuate the way they have been, or the tariff war heats up with the US. It is possible that yields go up, the BoC has suggested they may even have to raise rates again. This would mean that the market would be unlikely to see a significant rebound this year.

- A new AI model just hit the Interweb, DeepSeek AI. This AI large language model (LLM) came out of nowhere from a Chinese company. They were able to train the model for a fraction of the cost of ChatGPT, while delivering comparable performance, and also being Open Source (free). This news caused the market to fall somewhat on Monday. NVIDIA, the leading chip maker supplying OpenAI (and all the other big tech firms) with very expensive AI hardware to run their learning models on, saw a dip that caused NVIDIA to lose $600 Billion dollars in market valuation in one day. The following day it recovered around half that loss. Another model built by this firm was able to compete and outperform with one of the best image generation models currently available.

Stock Market Performance as of Wednesday Jan 29, 2025:

S&P 500: 6,039.31 (+2.91% YTD)

NASDAQ: 19,632.32 (+1.82% YTD)

S&P/TSX Composite: 25,473.30 (+2.31% YTD)

Macroeconomics Statistics:

Canada’s CPI Inflation Dec 2024: 1.8% (0.1% Decrease from Nov 2024)

Current BoC Benchmark Interest Rate: 3.00% (0.25% Decrease on Jan 29, 2025)

Unemployment Rate Dec 2024: 6.7% (0.1% Decrease from Nov 2024)

Greater Toronto Area (GTA) Real Estate Stats – December 2024:

November 2024 Average Selling Price All Home Types: $1,067,186

Y-o-Y (comparing Decembers) % Change in Average Selling Price: -1.6%

YTD Number of MLS Sales: 67,610

YTD % Change in MLS Sales (compared to this time last year): +2.5%

Y-o-Y (comparing Decembers) % Change in MLS Sales: -1.8%

Number of MLS Sales in December: 3,359

Y-o-Y (comparing Decembers) % Change in Active Listings: +48.5%

Number of Active Listings in December: 15,393

Inventory Available: 4.58 Months (Increase from 3.71 Months in November 2024)

Market Type: Buyers Market