Election Night:

Tonight there is an election in Ontario (at the time of writing this I’m not sure who won, but polls are suggesting the PC’s will win). During the election campaigning the party leaders spoke on a lot of issues. I wanted to do a bit of a review and analysis of the different housing policies that each party is running on and talk about what the PCs have accomplished so far, targets they set and if they were realistic, and what things continue to stand in the way of housing getting built in the province that I think the next government should tackle or implement.

Ontario Has A Supply Problem:

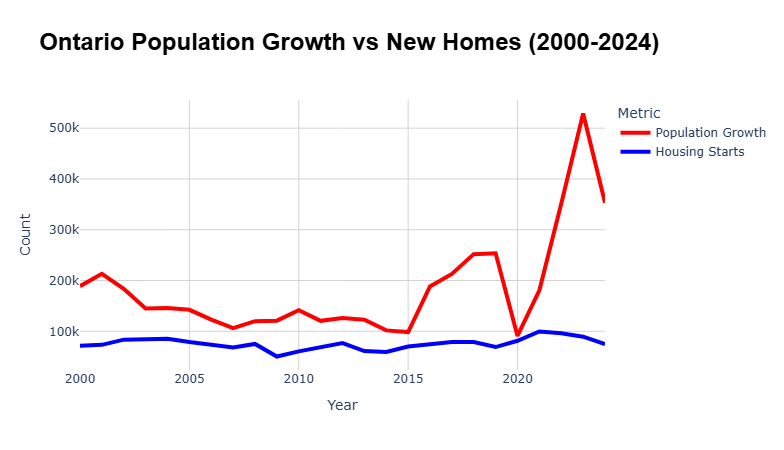

As I spoke about in my last post. The fundamental problem with Ontario real estate is that we do not build enough. Simple supply and demand. Not enough supply for the demand that we have, in rentals and end user homes. The amount of factors that influence housing is quite long, again, see my previous post. But just to name a few major ones that have led to the situation we’re in: exclusionary zoning (i.e. only one housing type allowed per lot, very hard to change zoning), lack of investment in trades for over 30 years, high construction and development costs, uncontrolled migration (importantly, with no housing to meet the new demand, migration itself isn’t generally a negative thing), and lack of purpose built rentals.

Will Our Changes Bear Fruit:

There are about a dozen more factors but these are some of the bigger ones that are keeping prices high. Every level of government appears to be trying to do something about the issue. But are they actually seeing results? When might all of this “investment” actually bear fruit? Or are we all too entrenched in our old ways to make a meaningful change that would actually improve housing supply (read: potentially hurt housing values for incumbents). Sometimes you have to upset people to get things done. But equally, there are ways to make meaningful changes and change attitudes without upsetting too many people, it’s just much more challenging. But lets see what my small set of ideas can do to change perspectives.

The 2022 Housing Affordability Task Force:

There was a report published by the Ontario Housing Affordability Task Force in 2022 which very plainly and simply stated that our housing problem will NOT be solved by measures to “cool” the housing market. Cooling down measures include: higher interest rates (which the governments don’t directly control), more tax advantaged accounts, higher leverage down payments, tax rebates, mortgage stress tests, and other incentives. While these things might be nice, they do not deal with the heart of the problem; a lack of building.

The Core Issue, Building:

We are now well aware that the fundamental problem for real estate in Ontario is that we do not build enough housing, and have not built enough housing, for years on end. This means as our population grew, the number of new housing units did not grow at the same rate. It was especially bad in the last 15 years or so. If we can all agree that our fundamental problem is construction of new homes, the next logical step would be finding ways to make building new housing easier. This includes higher density housing in areas where people may not be used to higher density housing.

Make Building Easy Again:

How do we make building easier? The big elephant in the background, is zoning. Our provincial and municipal land planning legislation is set up in such a way that makes it nearly impossible for anything other than single-family homes or mega skyscrapers condos to be built. You even see this in “new” communities, which arguably have the freedom to start from scratch and design a better suburb or city. If you look to a city like Milton, north of Oakville, they are developing old farmland there like crazy! And they’re putting in… Single family homes, or at best 3 storey townhomes, maybe a few condo apartments here and there on Main st. It kind of drives me crazy to see that a BRAND NEW city is being built the SAME OLD way? Where are the thoughts to transit, or cyclists, or rental apartments next to the new university, or multiplexes on a “quiet residential street.” For some strange reason we have an aversion to building small to medium sized apartment buildings on the same lot that a single-family home would go and Milton does a great job proving how our past failures are continuing to show up in our attitudes and mentalities towards home building.

Builders Aren’t The Problem:

Many people might want to go and blame builders for lack of a variety of housing supply. NIMBYs in our province get upset when a builder proposes putting in a 15 storey condo building on the corner lot off the main road at the entrance of your “pristine” residential neighborhood. Another example I saw was a builder wanting to expand the senior care facility next door by adding more height to help add more beds to our over-extended healthcare system. “These builders! How dare they try to change anything about my neighborhood! Imagine the traffic this will cause!” Don’t blame the builders. The builders are doing exactly what any rational actor would do in their shoes. If the zoning laws say, “sorry, but in 98% of this neighborhood, we won’t allow you to buy up a few houses next to each other and then redevelop it into a 4 storey, 20 unit apartment building, adding 17 units of supply slowly increasing density with time to meet the needs of our growing city.” Builders will do what they are able to accomplish within the law, or they’ll do the math on fighting the law and figure that if they have to spend 5 years fighting for a patch of land to be re-zoned and permitted, the only option that makes financial sense at that point is the 15-20 storey re-development. Same thing goes for builders who subdivide and build single family homes on new farmland in a new city. It’s probably well within the law to do so. It’s an easy win for them. We have to make other types of new developments and re-developments easy wins for builders and seriously cut down the friction.

An Old Example of What We Did Right:

I recently moved to Toronto and live a few blocks away from a main artery road inside of a residential area. There is a little main street nearby with a few restaurants, businesses, and corner stores. My street, built in the 1930s, adjacent to this area of commerce and a 7 min walk to my nearest subway station, is exclusively 3-4 storey apartment buildings. If you go further into the neighborhood it is almost exclusively streets lined with large single-family homes. On the same lot, these apartment buildings house 20-30 families compared to 1. But, if you look to the City of Toronto zoning bylaws, it would be illegal to build more of these apartments today in the same region. Not because they’re unsafe, we have 2 fully functional staircases and a fire alarm system connected throughout the whole building. But because of zoning lot coverage regulations, parking regulations, and regulations that prevent “changing zoning” even where it would make a ton of sense (i.e. on streets adjacent to shops and restaurants). Case and point someone bought up 4-5 homes on an adjacent street and has been waiting years for the city to approve their project which is quite moderate as far as projects these days go. There is approximately 0.5 parking spots (1 spot that’s blocked during the work day) for all 20 units of my building in an arguably “very residential” area. As far as I can tell, no one seems to mind. The main street provides necessities, transit provides convenience, new bike lanes (just outside the residential area) make that mode of transportation much smoother and safer, and more people get to benefit from all these features.

A Better Model That Seems to Be Working:

If you’ve ever been to a suburb of Montreal (or Montreal itself), you’ll notice that they do a lot of what I’m preaching here. They build a large variety of different housing types in a residential neighborhood where in Ontario you’d only see single family homes. This provides a variety of options for people who want to live in that area and reduces pressures on housing supply. I also mentioned in my last post that the way the legislation is designed in Montreal allows builders to be flexible with what they build on a lot, depending on what makes most sense at that moment in time (or what they think will make sense when the project is complete). This flexibility within the law allows them to do a much better job at meeting demand, and yes it means that things will change. We can’t continue to be immovable rocks that aren’t open to a modicum of change. We almost need to completely tear down and rebuild the way that we plan our land uses and housing in Ontario. The layers and layers of rules and regulations that have been stacked on top of each other just aren’t working anymore. Some people will get freaked out at the idea of tearing down rules and laws and think it will result in anarchy, that may be true. But, I’m suggesting replacing our current laws with ones that are proven to work, such as those found in Quebec, which aren’t perfect, but seem to be working a bit better. This line from the executive summary of the Provincial Housing Task Force sums it up pretty well: “The way housing is approved and built was designed for a different era when the province was less constrained by space and had fewer people. But it no longer meets the needs of Ontarians.” Honestly, if you haven’t read it, go read it, it’s very “based” (as the kids these days say). https://files.ontario.ca/mmah-housing-affordability-task-force-report-en-2022-02-07-v2.pdf

More Homes Built Slower Act, 2022:

Now that I’ve outlined what I think needs to happen, opening up zoning bylaws, adding more variety of housing, making building easier in general. Let’s chat a bit about what changes the provincial government has made and how housing is going so far. In 2022 we saw Bill 23 the “More Homes Built Faster Act” which aimed to reduce red tape for housing construction. This was passed in direct response to the housing task force recommendations of building 1.5 million homes by 2031, we’ll get back to that in a moment. One key change was allowing up to 3 residential units on land zoned single family residential, without requiring a zoning change, this includes construction of laneway or garden suites (ADU’s). Sources vary on what the actual numbers are on this new law. But in Toronto, where there are about 420,000 lots that may qualify for an ADU. A grand total of 126 have been built since this change (according to ADUsearch.ca). Even if we assumed a generous pipeline of 1000 units per year in say 2-3 years once more people get wind of building laneway houses. This “update” will mostly likely work out to a rounding error.

Condo’s Aren’t the Solution:

So that didn’t work, what else was included? In Bill 23 for rental developments of 4 or more units development charges will be reduced by 15-25 depending on unit size. According to the CMHC, “Among Canada’s three largest cities, Montreal posted a 112% year-over-year increase in actual housing starts in January while Vancouver recorded a 37% increase, both driven by higher multi-unit starts. Starts in Toronto fell 41% from January 2024, driven by decreases in multi-unit starts.” Alright, so that’s not going to well either. Multi-family starts have been falling in Ontario, which is a problem since those tend to supply a lot of housing. Again, wonder what Montreal is doing? A 112% increase in housing starts?! More than double from last year? Can we get some of that over here? There is a really big WHY in the room. Why is Toronto slowing down while Montreal is doubling? What on earth are we still doing wrong? The answer mostly lies in the fact that investors aren’t finding condos an appealing investment anymore, and builders aren’t able to sell enough units, and we have NO OTHER OPTIONS as far as supply goes. Which again shows that we haven’t managed to legislate a housing type into existence that varies from either single family or 50 storey condo tower. We also haven’t provided the right type of funding, or development charge cuts for smaller apartment buildings or multiplexes.

Ontario Land Tribunal, More of the Same:

Another change in Bill 23 was trying to speed up the processes in the OLT. They wanted to, “expand the Tribunal’s authority to dismiss appeals without a hearing, notably on the basis that the party who brought a proceeding has contributed to undue delay or if the Tribunal is of the opinion that a party has failed to comply with a Tribunal order.” Basically, they want to stop NIMBYs from causing delay in the development process. Fundamentally, I think this should be a good change. There is proven data that NIMBYs delaying the development process contributes to mountains of cost that ultimately get passed on to the end renters or owners of the units, and also makes building less appealing overall due to this risk. This still doesn’t address the fundamental change that is needed in our zoning bylaws, say it with me, VARIETY OF HOUSING TYPES.

The Middle is Still Missing:

What this effectively has accomplished is speeding up these mega projects. To be fair to residents of existing areas, often these projects seem a bit unwieldy and unnecessary when there could be a lot of smaller projects in the area that achieve the same amount of housing in a more graduated and “gentle” way. Inevitably you will hear people complaining about “greedy builders” who want to ruin the neighborhoods, when it’s our own legislation that’s handcuffing us. Again, builders are simply acting rationally, within the laws they’ve been given. A side effect of introducing this “Missing Middle” housing into legislation would likely also enable a greater number of smaller builders to take on these projects. The barrier to construction is quite high for very-high density projects. They require special, often custom engineering, massive re-bar concrete beams, and other construction materials that are very hard and expensive to ship or have to be custom built on site. This increases complication which increases costs. I’ll give this OLT thing a 1/2 point since the idea behind it is generally positive, but the foundation upon which it’s built sucks. It is still a drop in the bucket since there are so many other delays that continue to plague building and it’s not really a “solution”, just a band-aid on an existing problem.

What are the Results Saying and What Are the Projections:

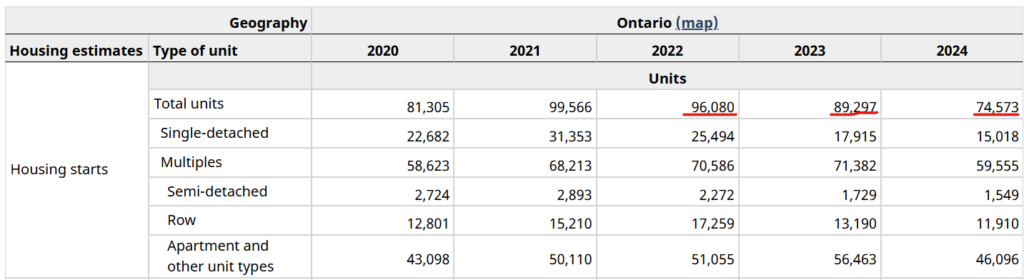

According to this table from Statistics Canada. Ontario housing starts have gone down every single year since the Provincial governments Housing Task Force report in 2022 and their proclamation to build 150,000 homes per year. I’m not going to turn a blind eye to the fact that the overall economic environment is pretty bad as far as construction costs and labour costs go. People’s appetite for investment with high interest rates is down, and a slew of other problems we are dealing with related to the economy. I also think it’s a bit unreasonable to use an above average year of 2021, with almost 100,000 starts, then project out and say “I think we can do 150,000.” Yeah, right, how exactly are you planning to do that overnight? We can’t expect changes to happen that quickly, but we also really can’t afford to go backwards. We’ve had 3 years since Bill 23 to see results. The data clearly shows that our changes have not been bold enough. We also can’t use the economy as an excuse when BOTH Vancouver and Montreal are improving. This data isn’t housing completions, this is simply “starts” which is getting shovels in the ground. We need more shovels in the ground and more people who are able to dig (read: trades workers). Ontario is still failing Ontarians. We need bolder changes.

Chart design: Oliver Foote

*technically housing starts, not new homes.

Data from Stats. Canada.

The Best Platform – Green Party?

I’m not going to get too much more into Ontario politics, but the one party that surprised me with their housing platform was the Green Party. Regardless of your political affiliation, I believe that good ideas are worth sharing. They are taking the approach of shooting for the stars on housing and aiming for 2 million new homes rather than 1.5 million. I think that is a good approach, because if we overshoot, we may still land on the moon.

They are also proposing a bunch of changes that coincidentally align with a lot of what I wrote about in this article. I like their bold thinking and we need more of this from all of the other parties to help solve our housing problems. So what are some things I like that they are proposing?

- Allowing single family homes to be divided into multiple condo units

- Pre-approved building designs for municipalities to instantly approve for construction

- Plan for mixed housing types based on demographic and immigration projections

- Allow fourplexes on existing lots, and sixplexes on existing lots in cities over 500,000 residents

- Remove onerous zoning rules around floor space index, set backs, planes etc.

- Pre-zone missing middle housing ranging from 6-11 stories on transit corridors and major streets in large urban areas with over 100,000 people

- Increase financial and legal support for small builders of missing middle housing

- End minimum parking requirements

- Change planning laws to allow various buildings to be built on main streets, transit stations, corridors, etc.

Real Changes Are Needed:

I do really like the ideas listed above and I think if they were implemented it would be a serious improvement to our zoning laws and these changes could actually get housing moving again in the province. Whatever the results of the election are, I hope that who ever is running the ship makes some real impactful changes.

Conclusion:

This was a bit of a long one, but I felt with the provincial election happening tonight that I needed to write out some of my thoughts on housing. What the current government has accomplished related to housing with their time in office isn’t particularly impressive. I believe if they continue along this path they won’t ever be able to accomplish their ambitious targets. But focusing more on pure data and the change that is required, I just don’t they’ll accomplish their targets on their current trajectory, on this particular issue I can’t say they have my confidence. I also don’t know which government WOULD be able to accomplish these targets since our system is so deeply broken. Whoever wins, they’ll have to make some very unpopular decisions. I just hope that the unpopular decisions are backed by data and proven success from other provinces or countries, not focused on personal affiliations or gains. This problem is not personal, it’s needs to be a unifying crisis. Thanks for reading, as always.

Keep Investing,

-Oliver Foote