Update Dec 14, 2024: Added Newsletter Email Archive at End of Post.

Bank of Canada Moves 0.5%

Coming off the back of a Bank of Canada rate cut of 0.5% on Wednesday, October 23rd, 2024 there are still some questions in the air about if/how/when we will see this change start to impact fixed rate mortgages, housing market activity, employment rates, inflation etc. I also wanted to briefly mention an anecdote I heard from a friend of mine since we are nearing Halloween and I thought it was interesting, related to the economics of Halloween.

Inflation Down from August

As it stands right now, the 5 yr government bond which fixed rate mortgages are based on, has actually begun to tick up slowly in the past 2 weeks, but the longer term trajectory is declining overall. The Bank of Canada said in their last decision discussion that if the economy begins to evolve in the way they anticipate that more rate cuts are on the table. Inflation as of Sept 2024 was down to 1.6%, oil prices dropped quite a bit more than anticipated which is helping, housing has finally also started to subdue, I have noticed this myself, that prices for housing rentals and purchase are becoming more competitive and even post interest rate cuts the “crazy increase in activity” hasn’t happened.

Prime Time For Home Buyers and Investors

There are still a lot of good deals out there for the savvy investors and home buyers, condos are somewhat oversupplied in many markets and I truly think that now is a once in a long time type of purchasing opportunity (feel like I’ve been saying that for 2 years, but I think we’re approaching the tail end of good deals). There is a great opportunity right now to get into a property at a great price with lots of choice on the market and ride declining interest rates, lock in a fixed rate a year or two from now at something closer to 3-4%. Once companies begin hiring again the hiring freezes are over, economy starts moving again, I’m predicting a very different market 12-18 months from now once these rate cuts have worked their way through the economy.

Local Real Estate Strains and Successes

The Bank of Canada has also predicted in their October 2024 Monetary Policy Report that GDP will climb as we go into 2025 and 2026 as compared to 2024 (which was a tight year, if you tried to renew a mortgage at the start of this year you’ll have felt the strain). So if we’re factoring everything in, expanding economy, lower inflation, decreasing housing prices, decreasing interest rates, 5-7 months of supply in some (great) housing markets, I really think this is a case of buy when others are selling. However, housing tends to be a very regional thing, some areas in Toronto have actually just continued to go up, through all of this, it’s almost like it’s own little bubble where the economic strains didn’t happen (generally in the 1.75 million – 3 million range in particular pockets).

The Problem with Condos (Oversupply & Office)

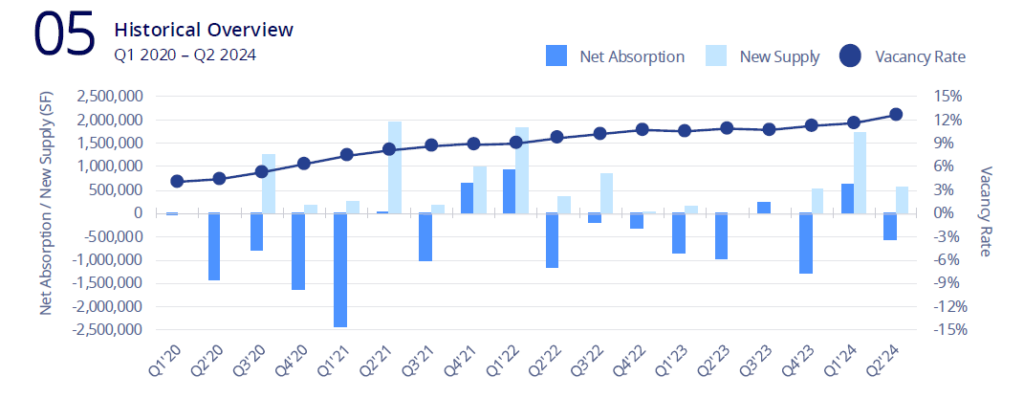

Condos on the other hand are dime a dozen right now, so much available, great prices if you know where to look, and very few buyers. Now, why are there few buyers, well if you go back to my last post where I talked about the increasing vacancies in office real estate you’ll have noticed that downtowns are having a harder time than suburbs are right now with a majority of office employees working from home 2 or more days a week. There’s simply not as much need to live downtown anymore, so people have moved out to the suburbs where they can get something larger and only have to commute downtown once or twice a week, not a bad deal especially considering you can get a bit more space for the same price as a shoebox downtown. I believe that the general economic malaise, in addition to the shift in expectations for office workers has led to a twofold issue of extremely high office vacancies (20% in some downtown areas), which has led to this oversupply of condo inventory as well. If you look at all these factors of different types of housing supplies building up in different areas they are all somewhat related to a simple yet profound change in the way that our world works post-covid (in part).

Consumers Are in “Wait and See” Mode

Another thing noted in the Monetary Policy report is that consumer spending has continued to decline from the start of the year to Q2 (and likely into the end of the year). Things like cars, vacations, and interest rate sensitive goods are all seeing declines compared to last year. People are feeling the strain, so the interest rate cuts are quite welcome. On a personal note, I was searching for an apartment to rent recently as well as potentially purchasing a used car, and it seemed like every time I looked prices were continuing to decline, “if prices will keep dropping, why not wait until they bottom out.” I’m sure that’s what a lot of people who are looking at housing and cars and any other large purchases are thinking right now. There will have to come a point where interest rates on loans are appealing enough that people will want to purchase their car or home or whatever else, either that or prices are low enough to entice the same. But the issue with just waiting for prices to come down is that we need people to be spending money for our economies to not collapse, so holding rates too high for too long can lead to some negative consequences that most people would not be too happy about.

United States Riding the AI Wave

Strangely through all this downturn stuff, the US economy and stock market has just been doing just fine. The US has a lot of growth companies, and have been able to ride this new “hype wave” of AI which has just injected even more excitement and money into their veins, meanwhile a resource based economy like Canada is suffering because of reduced demand and reduced spending on things like oil and gas, while supply of oil and gas continuing to improve. As an aside, Canada continues to be a bit of a place that is tough on innovators, there are tons of regulations, which arguably is good, but too much can lead to a stifling of innovation. Highly regulated sectors tend to favour incumbents, again, not necessarily a bad thing, especially in some sectors where regulation is extremely important.

Canada’s Lacking Innovation Problem

I don’t know that innovation is quite in the blood of Canada in the same way that some parts of the US “move fast and break things.” On the other hand, if you look at a lot of these “fast movers”, we’re essentially returning to baseline with some modern upgrades where now instead of 20 cable channels we have 20 streaming companies, and instead of taxis we have Ubers which are just as expensive or more expensive in some cases. There’s a great video about how tech companies are becoming worse and worse and basically once they undercut and drive out all their competition they cease to be good deals and with the monopoly they now hold increase their prices and leave people without any other option but to pay for their services.

Tech Company Monopolies, Poor Regulation

It’s a bit more complicated than that, but in a nutshell, that is what has been the ultimate result whether it was the intention from the get go or not. From a business standpoint, it’s just good business to try and get hold of a monopoly or something close to it, patents were invented with that idea in mind. Allow innovators to profit off their creations. But just as I was complaining about too much regulation, there are some sectors that do not have enough regulation or are too highly influenced to properly regulate and encourage competition. There are simple reasons why we can’t have a purely capitalist economy, and why a purely state run economy runs into problems as well. As with anything, there needs to be a good middle ground, in some ways Canada does a better job of this than the US, but with respect to innovation, I think Canada needs to be more encouraging of this and work on keeping our best potential innovators in Canada instead of just hopping over to the US where the rules are a bit more favourable.

Economics of Halloween (God Bless the Dollar!)

To close off this discussion I wanted to divert a bit and talk about Halloween. It’s not the largest shopping holiday, but it is one that almighty capitalism has invented to collect our dollars. I was speaking with a friend recently and was informed of these seasonal Halloween shops and the micro economies that they work in. Some of these smaller stores will top $1,000,000 in revenue just on this one holiday, retail margins tend to be significantly smaller than something like software, but if you have a few stores opened, each doing $1,000,000 in revenue, you have quite a solid business on a few months worth of work each year. So I was curious, how much money does Halloween bring in each year? I only have the US numbers and they tend to spend a bit more than Canadians but it’s interesting nonetheless. In 2023, Americans spent $12.2 Billion on Halloween. Seems like a lot of money. To give a frame of reference Amazons 2 day “Prime Day” sale this year generated $14.2 Billion in revenue. So, while Halloween is quite popular among children and their parents. Amazon, in just 2 days, does more revenue. Other holidays spending for reference: Valentines Day $25.9 Billion, Black Friday online sales $70 Billion, Easter $22.4 Billion. Halloween at $12 Billion is a good attempt at a shopping holiday, but it doesn’t seem to have as much mass appeal as pretty much any other shopping holiday. Moral of the story, give Halloween a boost and buy some chocolates this year :P. Just thought this was kind of interesting. That’s all for my economic brain chaos, thanks for reading.

Keep Investing,

Oliver

Newsletter #24: Bank of Canada Rates and Economic Impacts. Slower Return to Housing Market

This Weeks Blog Post:

Rate Cuts and Housing, The Booming US Economy & Canada’s Innovation Problems:

- Why does it seem like the US in invincible

- Why tech companies get worse and worse every year, the undercut and monopolize strategy

- Small tidbit on Halloween and shopping holiday economics

Read the full article here: https://oliverfoote.ca/canadas-economy-vs-the-us-innovators-technology-housing/

Market Talk:

- This weeks market talk is sort of woven into the blog post. But effectively. yay! 50bps rate cut! Bank of Canada says more to come. Economy should improve in 2025-26. Housing still slow, especially condos. Amazing time to be a buyer. Probably won’t see this type of inventory again for 10+ years if rates continue coming down.

Event Update!

- Thank you to those who have already indicated interest in my event (details below)!

- If you would like to be a part of it you can respond to any of my emails until the event with: “sign me up!”

- If you have done so already, expect to receive a Zoom link about 1 week prior to the event.

Topics:

- Mortgage rule changes coming Dec 15, 2024,

- how interest rates are affecting housing & the economy,

- and more!

Details:

- Date: Saturday Nov 16th, 2024 @ 10:00AM

- Duration: 45 mins – 1 hr

- Location: Zoom! (Webinar)

- Special guest: Deren Hasip from Mortgage Scout

Hope to see you there!

Market Performance as of Friday October 25, 2024:

S&P 500: 5,808.12 (+22.46% YTD)

NASDAQ: 18,518.60 (+25.41% YTD)

S&P/TSX Composite: 24,463.67 (+17.21% YTD)

Canada CPI Inflation Sep 2024: 1.6% (0.4% Decrease from August 2024)

Current BoC Benchmark Interest Rate: 3.75% (0.5% Decrease on Oct 23, 2024) Unemployment Rate August 2024: 6.6% (0.2% Increase from July 2024)

Subscribe to our newsletter!