Update Dec 14, 2024: Added Newsletter Email Archive at End of Post.

I was having a discussion today with my co-workers and we were (very professionally, might I add) complaining about all the times people have asked us to do something that should have been understood to be the other (third party) persons responsibility. I recently had multiple experiences where I was roped into doing someone’s work for them. A good example of this is that twice in the last month I would probably have never received my a commission cheque if I hadn’t followed up and insistently asked to get paid (weeks after I was supposed to, might I add). So all of these things just stacked up and got me thinking. If there are so many people being so lazy out there and making good living wages just doing the bare minimum. Making other people do the work for them, am I missing something? Should I be more lazy? Another word for this type of lazy would be “delegating”, but I’m not sure where the lines are between, favours, delegation, just plain lazy. So I want to unpack this a bit and talk about what lines I think are reasonable and how to better delegate work if that is a part of your job. Getting people to do things is never easy.

Delegation, the thing that all managers have to do and will become very familiar with in their day-to-day work life. If you are trying to get someone to do something. What is the best way to do it? Well for starters, generally speaking, paying someone to do tasks is a good motivator. I work 100% for commission, so when I’m asked to do something I’ll take a bit more convincing, because if I can’t draw a line from point A to point B, and I find I’m quite generous with my time and my lines, the motivation to get that thing done just sometimes isn’t there, especially if I feel like I’m just handing out favours left and right. But I have come to realize that there’s a lot more to working on a team, even if it’s commission only, than just “how will this help me get paid.” It’s important to see the bigger picture, spend time planning for future business, and in general building good relationships with the people you work with so if you do need a favour they’ll be more willing to oblige. It always helps if there’s a trade of some kind. For example, I recently moved to Toronto and borrowed a truck from my company and proceeded to lose the gas cap (tired brain, left it as the gas station). In exchange for using the truck and the lost gas cap, I helped de-stage a few homes. Which to me was a decent enough trade to motivate me to be there.

If you have people who are working for a salary, you might be thinking, “well I’m paying them, they should just do whatever I tell them to do.” This is partially correct, but employees can sometimes box themselves in and think in the mindset of, “I was hired to do a certain thing for you, and anything outside of that is someone else’s job, so I won’t do it.” This again, is where good old trading comes in, people are selfish. Blame self-preservation. But even generous people can have a limit on how much “unrelated to their work BS” they’re willing to put up with. Therefore, if you can make it extremely clear, what someone will be getting or has already gotten, in exchange for them doing something that might not be in the job description for you, it becomes a lot easier to get them to do that thing. I would largely frown upon using a power imbalance to your advantage here, or threats, that’s a great way to build a culture where no one trusts anyone else. Think long term, be polite, and be helpful to others and they’ll do the same for you. There’s also something called building goodwill, some people will take advantage of it, but if you’re in a bit of a lower position, or you’re just starting out on something, you may find it a good idea to put up with a bit more BS. Because when you need a favour from someone higher up, they’ll be much more wiling to help you out, obviously safety first, don’t do anything unreasonable.

I’ll be honest, I’m a complete novice at this organizational behavior thing, I took one course in university about it, and it didn’t involve much psychology. More macro scale how companies behave, all of what I’ve written so far mainly comes from observations, chatting with others, and personal experiences working. On an individual level it’s much more important to have frank conversations with people about what they are thinking and how they are feeling about their work. Sometimes you may just be asking someone to do something that they are clueless about and they might not be willing to admit it because of their ego. Everyone can fall into little traps like this and it’s important to keep good relationships, ask people how they’re doing, and try to see the human behind the work.

I’m going to move on to somewhat of a tangent right now. But something that I find irritating when it comes to employment, is that people teach good management principles that are something along the lines of “help people, help them fail fast, people make mistakes and sometimes you have to fix them.” Some companies are just completely cutthroat and if you underperform their metrics it’s game over, but most will have some amount of leniency. The part that bothers me is when they’re hiring for an entry level position and require 5 years of experience, and during the interview seems like you’re expected to know how to do the job at their company already using their very specific software’s and systems that they’ve built internally. Let’s not even get into the online application portal hiring process. For the love of God, don’t spend a minute online until you know someone. You’re better off spending just an hour a day talking with people even loosely in the field your interested in vs. spending 4 hrs a day applying to jobs on portals where no one will ever read your resume. Give yourself a chance. Yes in the era of the internet and social media, I’m telling you the best way to get a job is talk to people. Interesting how that hasn’t changed.

Back to the regularly scheduled programming. So how do you harness your inner lazy to get more things done, and how do you stand up for yourself and your own productivity and time. Prioritizing is very important, you want to make sure you know what you are doing, and when you are doing it, so if someone asks you “hey can you do this thing for me,” you do not have to default to saying yes. I don’t want to sound like I’m telling you as an employee to NOT do what you’re being told to do, but I do want you to take responsibility for your own time. I think if you’re self employed this is extra important, health and fitness are important aspects of performing at your best, so schedule in that time, an appointment with yourself if you will. I now have a bit of a wonky schedule and work on specific days in Toronto and Mississauga. So if I’m asked to do something in the city on the day which I’m not available there “I’m all booked up.” Even if I end up not having much else to do in the other city on that particular day. Setting boundaries and lines for yourself is important. But it is also very important to be flexible to good opportunities when they present themselves. There’s a balance that needs to be walked, and depending on your job you may have more flexibility for one type of thing and less flexibility for another, you have to learn where it is important to move your schedule around and where it can wait.

By the same token, you’ll be surprised how many people are willing to help you simply if you’ve been helpful to them or you are a nice person. Just asking someone to do something will often result in them obliging even if it’s a slight inconvenience, no one wants to be perceived as unhelpful. Obviously, this can be taken advantage of and I don’t recommend doing so. But if it’s nothing too crazy, maybe you’re just asking for 5 minutes of advice, or you just want to learn something. Many people, even people who’s time costs more than your annual salary, are willing to oblige and help someone out if they’re asked nicely.

For example, if I see someone marketing a home in a way that I haven’t considered before, I’ll just give them a quick call and ask how they did it, if they’re a person with a collaborative attitude who wants everyone to do better, they’ll have no problem telling me exactly what they did. Complimenting someone on something they’ve done that you liked, and then asking for advice on how you can do it yourself, is probably the easiest way to get someone talking and willing to help. Remember, when building relationships it’s not about yourself, the more questions you are asking the other person about themselves, the more engaging they’ll find the conversation. People are extremely willing to help out if you take a genuine and personal interest in them and not necessarily in their work. Usually, work is just a small part of a person’s bigger life and getting to know not just their work but other things about them as a person can be very helpful in asking for favours and building good relationships in general. Like anything practice makes perfect when it comes to building relationships, start small, get a bit outside your comfort zone, and keep trying.

That’s all for now, this is a bit of a shorter one, had a big move to the big city recently (I smell opportunity!) and haven’t had much time to pump this out. But hopefully you are able to take a few things away from this and find that people are often more than willing to help out, as long as you are polite and come across and helpful yourself, and take an interest in the person behind the thing they do.

Keep investing,

-Oliver

Newsletter #27: How Being Lazy Can Help, Interest Rate Improvements, 2025 Market Acceleration

This Weeks Blog Post:

Get Lazy & Build Relationships:

- Talking about how to get other people do (politely) do what you want them to do

- Management strategies for employees

- Learning to build relationships with people instead of wasting time in front of your computer

Read the full article here: https://oliverfoote.ca/get-lazy-build-relationships/

Trreb Market Stats Nov 2024:

- Winter is slowly moving in, bring on the winter sports! In sharing some warmer news the Greater Toronto Area home sales increased strongly on a year-over-year basis in November. Many buyers benefitted from more affordable market conditions brought about by lower borrowing costs. The number of new listings were also up compared to November 2023 but by a much lesser annual rate. This is resulting in tighter market conditions and contributing to overall average price growth compared to last year. With the momentum we are experiencing I’m expecting a bit of a slow but steady market recovery in 2025.

- There were 5,875 home sales through November, up by 40.1% compared to 4,194 sales reported in November 2023. Total active listings on the MLS® System amounted to 21,818, up by 30.2% year over year. November sales were up month-over-month compared to October. The average selling price was up by 2.6% compared to November 2023 to $1,106,050 in the GTA overall.

- Toronto’s Regional Real Estate Board Chief Market Analyst, Jason Mercer, recently stated that on a seasonally adjusted basis, the average selling price edged slightly lower compared to October. Although market conditions have tightened, particularly for single-family homes, the detached home market in particular experienced average annual price growth above the rate of inflation, particularly in the City of Toronto. However, the condominium apartment market continues to experience lower average selling prices compared to a year ago. Condo buyers are benefitting from a lot of choice, giving them negotiating power. This will attract renter households into homeownership as borrowing costs trend lower in the months ahead.

- I wish you and your family a fantastic holiday season and I look forward to connecting with you very soon. Happy Holidays!!

Other News:

- It appears that despite the proposed tariffs from our neighbors to the south, the Bank of Canada may still be on track to cut interest rates tomorrow (Dec 11, 2024), with some predictions anticipating another 0.5% cut, looking at 5 year bond yields after a bit of a pop post election they have begun to trend back down to the lows we saw in October 2024. If this trend continues going into the holidays and the New Year, we can expect buyers to be pleasantly surprised by how much their purchasing power on a fixed mortgage has improved.

Above chart from marketwatch.com

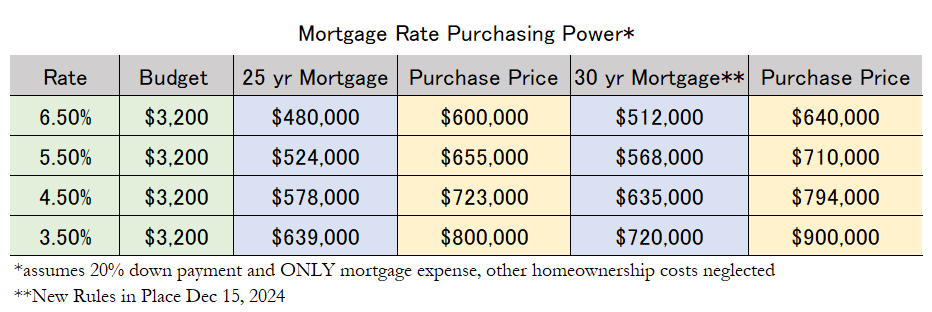

- On top of this a slew of NEW mortgage rules will be coming into place on Dec 15, 2024 (you can learn about them at my YouTube presentation here: https://youtu.be/8XyHEV1c7R4) which for first time buyers will instantly provide them with an improvement to their purchasing power as well.

- You can see below the difference that a 1% change in interest rates makes to the potential mortgage amount someone can afford on the same 3200 budget.

With low-down payment mortgages being allowed up to 1.5 million dollars this also will improve affordability in some slightly more expensive markets and bring a wider array of potential buyers to those homes.

Above chart made by yours truly.

Stock Market Performance as of Tuesday Dec 10, 2024:

S&P 500: 6,044.60 (+27.44% YTD)

NASDAQ: 19,687.07 (+33.33% YTD)

S&P/TSX Composite: 25,565.73 (+22.49% YTD)

Macroeconomics Statistics:

Canada’s CPI Inflation Oct 2024: 2.0% (0.0% Change from Sept 2024)

Current BoC Benchmark Interest Rate: 3.75% (0.5% Decrease on Oct 23, 2024, next decision: Dec 11, 2024)

Unemployment Rate November 2024: 6.5% (0.1% Decrease from Sept 2024)

Greater Toronto Area (GTA) Real Estate Stats – November 2024:

November 2024 Average Selling Price All Home Types: $1,106,050

Y-o-Y (comparing Novembers) % Change in Average Selling Price: +2.6%

YTD Number of MLS Sales: 64,277

YTD % Change in MLS Sales (compared to this time last year): +2.7%

Y-o-Y (comparing Novembers) % Change in MLS Sales: +40.1%

Number of MLS Sales in November: 5,875

Y-o-Y (comparing Novembers) % Change in Active Listings: +30.2%

Number of Active Listings in November: 21,818

Inventory Available: 3.71 Months (Increase from 3.5 Months in November 2024)

Market Type: Buyers Market

Thanks for reading and have a great week! -Oliver Foote

Subscribe to our newsletter!