Update Dec 14, 2024: Added Newsletter Email Archive at End of Post.

It’s Not Looking Good for Office:

Office real estate (even including the biggest and best downtown offices) are struggling. The market is continuing to get worse, with one of the longest downturns in the office real estate markets history. In your day-to-day life, the real estate of your place of work probably doesn’t cross your mind too frequently. But, this is quite an interesting discussion to have about the nature of work and how COIVD has changed the office market, likely forever, and if or when things might start to improve. After receiving some boots on the ground information relating to a prior post I wrote talking about commercial real estate I’ve come back to talk specifically about office spaces, since many people may either see an opportunity in office real estate, or something they would rather stay away from (I prefer the opportunity outlook). I am a tad bit optimistic on the long term outlook, but after digging into the numbers a bit more the present situation was somewhat of a shock to me.

Office Real Estate’s Prolonged Rise in Vacancy Rates:

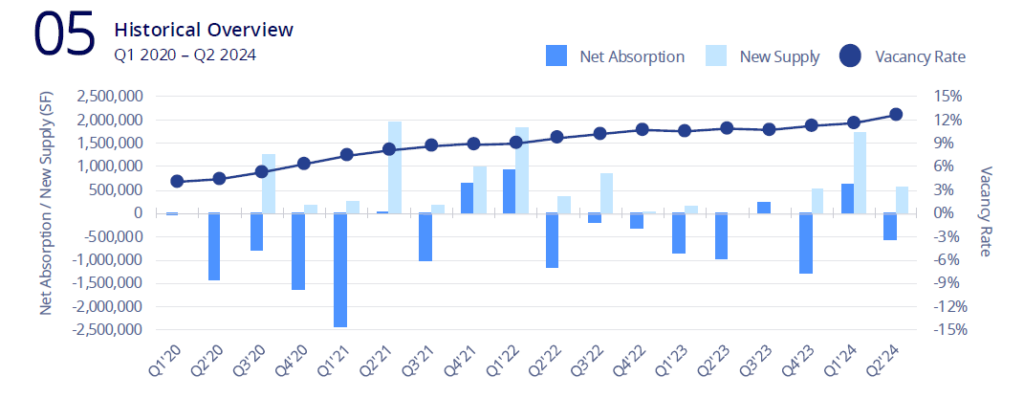

Colliers Canada is a commercial real estate research firm and they publish office reports every quarter at their website. Looking at this report from Q2 2024, there is a chart on the bottom of the second page, that really shows the bleakness of the office real estate market (reproduced below):

Office vacancy, new supply, and net absorption. Greater Toronto Area 2020 – 2024. Colliers.

The point that most interested me was the vacancy rate. It has been climbing from a low of about 4% just as COVID hit, to just around an average of 13% today. There is another chart which shows areas in Toronto and around the GTA and it seems that suburban office spaces are faring just a little bit better than the downtown, and midtown regions. This is a 30 year high in office vacancy rates, and it’s happening across Canada and the US. Additionally, this is the most prolonged timeline of climbing vacancy numbers in office real estate. In the past office real estate was really a sound long-term investment as long as the location was solid, now there has been somewhat of a paradigm shift. In prior recessions the office market usually reached it’s peak vacancy rate about 2 years out then began to improve. This time, things are different.

Why Are Vacancies Getting Worse Four Years Out?

The natural question to ask about this chart is why do these numbers continue to climb? There could be many answers to that question, I’m going to hypothesize a few, but they all center around the changes that COVID injected into the world of work. At this point we all know the work from home story of the pandemic, and how even a few years after the outbreak, people are not back in the office full time, and it makes sense. Many people who were commuting downtown from a suburb 5 days a week benefited from the time and money savings that working from home provided. After having worked from home during the pandemic and being able to flex their schedule a little bit to deal with kids or a family obligation going back is a tough ask.

New Working Ways Are Here to Stay:

Getting people to go back to their old ways is just not going to happen, especially when they feel that there is a better way to work. Many people I’ve spoken to working for larger companies are downright refusing to come downtown more than 2 times a week. A dispute over 1 day in the office this way or that way isn’t worth firing someone over for a lot of companies, especially if the employee is in a good enough position to negotiate. This and similar trends leave the company with a vacant office more than half the time, so they begin to downsize, try to sublease or some other solution.

Downsizing or Rightsizing?

That vacancy chart is effectively showing the aftermath of companies slowly and continually downsizing their leases, or simply not renewing. The reason it was so slow and protracted is because commercial leases tend to be 5 or 10 year leases. As office leases were coming up for renewal during the pandemic, businesses would downsize the amount of office space they needed since half their workforce was working from home. Assuming an average of a 5 year lease timeline, this would suggest that vacancy will continue to get worse until around the 5 year mark as the demand stabilizes and companies understand how much space they want to lease for the new post-pandemic world of work.

What to Do With All This Space?

You may be wondering what is going to happen with all this vacant office space. Well it is possible that the market will recover as the overall job market and economy recovers (see rate cuts) and companies begin expanding once again, but there will still be a considerable amount of un-rented office spaces especially if the office spaces are not AAA downtown spaces. It’s likely that some landlords will have to sell their spaces. You might think that a natural adjustment for the market to make is to simply convert some of those office units into residential units. The problem is that even a simple conversion like this requires lots of time, red tape, money etc. The building code for residential units gets more strict every year (for safety and other reasons), or there may just be no way for a conversion to happen due to the location of walls or other hurdles.

Why Conversions May Not Be Possible:

Even if it can be done it can be prohibitively expensive for smaller landlords to justify the cost of conversion unless they are willing to wait for quite a while to see the return on their investment. Some conversion projects to condos have been a success, this is where your “loft” style residences come from. But if you’ve been following my posts recently, you’d know that new construction condominiums are also having their worst year in more than 2 decades, people simply cannot justify the cost of a new condo, especially when the market is being flooded with existing condo inventory and rates (up until very recently) are so high making everything more expensive.

Will Improving Macro Be Enough?

The options for landlord of office real estate right now are quite limited. If they consider a conversion to a more “retail” style change, they are also facing the problem of more people shopping online. Retail is taking it’s time coming back and while upscale malls are doing ok, many retail establishments are struggling more than they are improving. There is some good news however, it seems like times are changing in the overall macro environment. Jobs numbers came back with improvements in the latest Stats Canada jobs report, inflation seems to be under control, and the Bank of Canada is expected to cut rates a further 50 bps at their next announcement. Which would be a total drop in the benchmark lending rate of 1.25% just this year. These cuts should help get business up and running again and people spending money again since credit will get cheaper, loans, mortgages, and prices will (hopefully) stay somewhat under control.

Why Industrial Survived the Pandemic:

I think that office real estate vacancies will begin to improve sometime in the next year (or two), but it will be a slow and gradual process and there may be a new normal of somewhat higher vacancy rates. Industrial has managed to maintain their relatively low vacancy rates especially outside the city but as mentioned above, with online shopping and stores becoming more and more prominent, we’d expect industrial to have fared a bit better. A home office is much easier to build than a home warehouses or manufacturing facility. It’s also possible that in the long term the use of these buildings will have to be completely changed even if the process is a long and drawn out one.

Final Thoughts on Office:

I know that long and drawn out is never what you want to hear when the news is negative, but that seems to be the situation that office is in for the time being. Leaning back into my more optimistic side, I think that just maybe, people will be looking for types of spaces that aren’t your traditional office setup, but are a place that they can go to get an office like feel, but that is outside of their home. From personal experience I can find home to be a bit distracting trying to get any work done. But, I’m not sure how big of a market there is for this type of thing and it goes very much against the traditional commercial real estate business of renting out to one long term, stable tenant. Maybe the types of contracts will have to become more creative with potential tenants. I don’t have the answer to the problem with office real estate, but whatever it is will require a lot of creativity and will be faced with a lot of challenges and competition (supply). I don’t think it’s doomsday for office, but I think there’s a long road ahead. That’s all for now.

Keep Investing,

Oliver Foote

Newsletter #23: Office Real Estate is Suffering. Residential is Due for a Jump

This Weeks Blog Post:

How Much is Office Real Estate Suffering?

- This article is all about office, after some inspiration I decided to read some reports and the outlook at this moment in time is shall we say… Bleak.

Read the full article here: https://oliverfoote.ca/how-much-is-office-real-estate-suffering/

Market Talk:

- Most of my market talk will be limited this week. But I have been noticing that there is tiny bit of a pickup happening in the market. With fixed mortgage rates coming down so much people are starting to realize this and homes are beginning to sell. It is gradual, but the past week or two has seen a couple more people at open houses, and a couple more people showing interest in homes.

- I suspect the rental real estate market will stay somewhat muted since there is still a huge supply of condos in downtown Toronto and we are approaching that point where purchasing vs. Renting is starting to become quite close in price, within 300-400 dollars per month, and it’s usually right around this time that rental demand jumps, or prices jump, and I vote that prices will see a bit of a jump going into the end of this year and the start of next.

- Additionally, we have two more rate announcements coming this year with it looking like there will be cuts at both. How much is TBD, but I’m hearing 50 and 25 bps. If that is the case I believe in the new year the real estate market will have a renewed energy and supply will start to become an issue again in short order. If you’re looking for a place, seriously, now is the time to buy. If you have the luxury to hold on, sell when the market pops. Obviously, every situation is different and you should consider and consult before deciding what your best approach is.

Market Performance as of Friday September 27, 2024:

S&P 500: 5,859.85 (+23.55% YTD)

NASDAQ: 18,502.69 (+25.31% YTD)

S&P/TSX Composite: 24,471.17 (+17.24% YTD)

Canada CPI Inflation Aug 2024: 2.0% (0.5% Decrease from July 2024)

Current BoC Benchmark Interest Rate: 4.25% (0.25% Decrease on Sept 4, 2024)

Unemployment Rate August 2024: 6.5% (0.1% Decrease from August 2024) (Everything is green! Improvements ahead!)

Subscribe to our newsletter!